Simplify your finances, stay tax-compliant, and focus on growing your business.

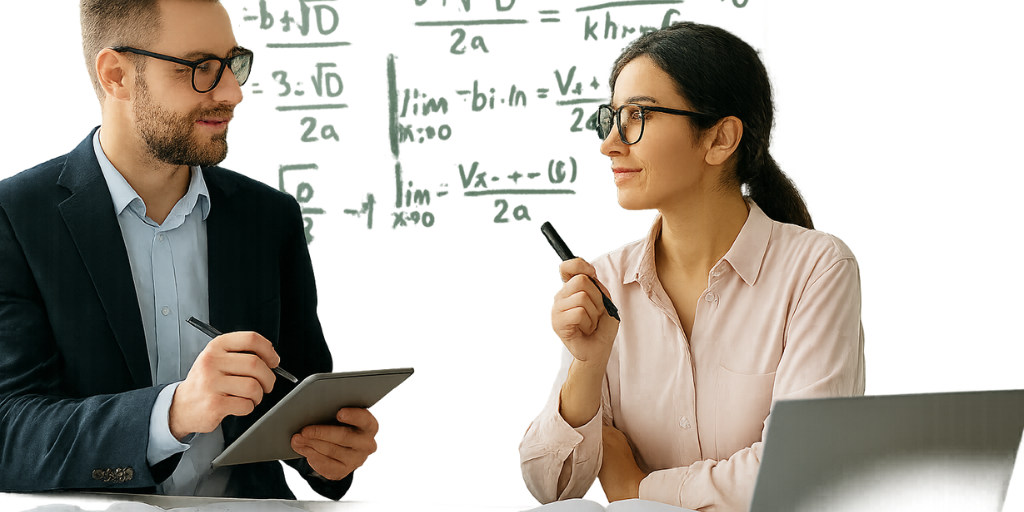

Freelancers and self-employed accounting in the UK involves managing taxes, expenses, and financial records for individuals who work independently. It ensures accurate bookkeeping, timely tax submissions, and compliance with HMRC regulations helping you stay organized and make confident financial decisions.

Clear, simple, and reliable accounting for independent professionals.

We start by understanding your work, income sources, and accounting needs to set up your financial system correctly.

We organize your records, manage invoices, and track expenses to keep your accounts accurate and up to date.

We handle your Self Assessment and ensure you claim all eligible deductions while staying compliant.

Get year-round guidance to manage your cash flow, plan for taxes, and make smart business decisions.

Our Accountants for Freelancers and Self-Employed Services

Tailored accounting solutions for UK freelancers, ensuring stress-free tax returns, expense tracking, and financial clarity.

Specialist accountants for IT consultants, helping you manage IR35, VAT, and project-based income with ease.

Accounting support for software and web developers, from handling complex invoices to optimizing tax efficiency.

Dedicated accountants for marketing consultants and agencies, streamlining finances so you can focus on client growth.

Creative-friendly accounting for designers, covering project billing, expenses, and tax planning.

Expert accountants for authors, journalists, and copywriters, ensuring royalties and freelance income are managed smoothly.

Accounting services for photographers, from equipment expenses to managing seasonal income and tax reliefs.

Specialist accountants for videographers, helping with project-based invoicing, VAT, and financial planning.

Professional accounting for private tutors, simplifying self-employment taxes and income tracking.

Accounting support for personal trainers and coaches, covering expenses, tax returns, and business growth advice.

Designers, writers, photographers, and artists who need simple accounting for project-based income.

Developers, consultants, and contractors managing multiple clients and remote projects.

Personal trainers, therapists, and coaches handling self-employed income.

Builders, electricians, and plumbers working as sole traders or subcontractors.

Social media managers, copywriters, and consultants managing variable cash flow.

Clients save an average of 20% on annual tax bills through better expense management.

At quilliammarr.co.uk, we’re a team of qualified accountants, certified tax advisors, and experienced business consultants dedicated to helping you achieve financial success. With expertise in managing company tax accounts, HMRC business tax accounts, and providing tax account online services, we ensure seamless and efficient financial management tailored to your needs. Our dedicated team provides the following benefits to businesses and individuals across the UK.

Our robust security measures ensure the privacy and confidentiality of all client information, giving you peace of mind while working with our trusted tax accountants.

Strategic VAT planning helps optimize your tax position through: Identifying recoverable VAT Selecting optimal VAT schemes Structuring transactions efficiently

Stay compliant effortlessly with our system of timely alerts for HMRC business tax accounts and filings, ensuring you never miss a deadline and maintain perfect compliance records.

We provide personalized, flexible solutions for HMRC business tax accounts, ensuring your unique needs are met across the financial spectrum with detailed analytical insights.

Start with a free consultation to gain valuable insights from experienced tax accountants for strategic financial planning and decision-making. You don't need to do anything, just expert guidance.

Our qualified tax accountants are committed to delivering meticulous, client-focused services with a professional approach, customized to your specific business needs.

Yes. An accountant helps you manage bookkeeping, handle your Self Assessment, and ensure you claim all tax deductions while staying compliant with HMRC.

You can claim business-related costs such as office supplies, travel, equipment, marketing, and a portion of home office expenses.

You’ll need to register with HMRC for Self Assessment, track your income and expenses, and file your tax return annually usually by 31 January.

Yes, we use HMRC-approved software to ensure your records and submissions comply with the latest MTD requirements.

Your trusted partner for stress-free accounting and tax management.

Hassle-free tax filing for freelancers and contractors.

Keep your finances organized with accurate and up-to-date records.

Ensure proper VAT setup and timely submissions to HMRC.

Request a schedule for free consultation

3 embassy drive, Calthorpe road,

Birmingham, B15 1TR

+44 7961 090248

Info@quilliammarr.co.uk

Your trusted accountancy

partner. navigating financial

success together.

Quilliammarr is a UK-based firm providing expert accounting and financial solutions for businesses and individuals, backed by a team of qualified accountants, tax advisors, and business consultants.

Navigation

Contact Info

am providing my services as the Managing Partner and Tax Specialist. My expertise includes helping medium and small-scale businesses in their accountancy and legal requirements, business start-up support

am providing my services as the Managing Partner and Tax Specialist. My expertise includes helping medium and small-scale businesses in their accountancy and legal requirements, business start-up support

Expertise:

Accountancy

Legal Requirements

Business Start-Up Support

Payroll System

am providing my services as the Managing Partner and Tax Specialist. My expertise includes helping medium and small-scale businesses in their accountancy and legal requirements, business start-up support

am providing my services as the Managing Partner and Tax Specialist. My expertise includes helping medium and small-scale businesses in their accountancy and legal requirements, business start-up support

Expertise:

Accountancy

Legal Requirements

Business Start-Up Support

Payroll System

am providing my services as the Managing Partner and Tax Specialist. My expertise includes helping medium and small-scale businesses in their accountancy and legal requirements, business start-up support

am providing my services as the Managing Partner and Tax Specialist. My expertise includes helping medium and small-scale businesses in their accountancy and legal requirements, business start-up support

Expertise:

Accountancy

Legal Requirements

Business Start-Up Support

Payroll System

am providing my services as the Managing Partner and Tax Specialist. My expertise includes helping medium and small-scale businesses in their accountancy and legal requirements, business start-up support

am providing my services as the Managing Partner and Tax Specialist. My expertise includes helping medium and small-scale businesses in their accountancy and legal requirements, business start-up support

Expertise:

Accountancy

Legal Requirements

Business Start-Up Support

Payroll System

am providing my services as the Managing Partner and Tax Specialist. My expertise includes helping medium and small-scale businesses in their accountancy and legal requirements, business start-up support

am providing my services as the Managing Partner and Tax Specialist. My expertise includes helping medium and small-scale businesses in their accountancy and legal requirements, business start-up support

Expertise:

Accountancy

Legal Requirements

Business Start-Up Support

Payroll System

am providing my services as the Managing Partner and Tax Specialist. My expertise includes helping medium and small-scale businesses in their accountancy and legal requirements, business start-up support

am providing my services as the Managing Partner and Tax Specialist. My expertise includes helping medium and small-scale businesses in their accountancy and legal requirements, business start-up support

Expertise:

Accountancy

Legal Requirements

Business Start-Up Support

Payroll System