The UK tax year runs from 6 April to 5 April, and knowing these dates is essential if you want to stay compliant with HMRC and avoid penalties. Whether you’re self-employed, a landlord, or running a limited company, the tax year sets the deadlines for filing returns, paying taxes, and meeting other obligations.

Research in 2024 shows that more than 11.5 million taxpayers filed their Self Assessment on time, but over 1.1 million missed the deadline, each receiving an instant £100 penalty plus growing fines.

Let’s break down the 2025/26 tax deadlines, including VAT, PAYE, Corporation Tax, dividend tax rates, and smart planning tips.

When Does The New Tax Year Start?

Staying on top of your taxes means knowing exactly what to file, when to file, and who it applies to. Below is a simple breakdown of the essential UK tax deadlines every individual, sole trader, and limited company should keep track of:

|

Deadline |

What It’s For |

Who It Applies To |

How to Handle It |

|

Monthly (22nd) |

PAYE and NIC remittance |

All LTDs running payroll |

File RTI submissions and pay HMRC by 22nd of each month. |

|

Quarterly or Monthly |

VAT return and VAT payment |

VAT-registered companies |

File MTD VAT returns digitally and pay any VAT due. |

|

6 April |

Start of new tax year |

All taxpayers |

Review allowances, reset planning strategies, and organise financial records. |

|

31 May |

Distribute P60 forms |

All employers |

Generate and send P60 forms to employees showing annual pay and deductions. |

|

6 July |

Submit P11D/P11D(b) returns |

LTDs providing benefits |

File online and pay Class 1A National Insurance on employee benefits. |

|

22 July |

P11D Class 1A NIC payment |

LTDs with benefits |

Pay Class 1A NIC on benefits reported in P11D by this date. |

|

5 October |

Register for Self Assessment |

New self-employed or landlords |

Register online with HMRC to receive UTR number. |

|

31 October |

Paper Self Assessment deadline |

Individuals filing paper returns |

Post completed paper returns to HMRC by this date. |

|

31 January |

Online Self Assessment + Tax payment |

All Self Assessment taxpayers |

File online and pay any tax due. |

|

Accounting Period + 9m |

File Corporation Tax return (CT600) |

All LTDs with profits |

Submit CT600 online via HMRC portal, including accounts and tax computation. |

|

Accounting Period + 9m+1d |

Pay Corporation Tax |

All LTDs with profits |

Pay corporation tax to HMRC within 9 months and 1 day of year end. |

|

Accounting Period + 12m |

File Company Accounts with Companies House |

All LTDs |

Submit annual accounts digitally via Companies House WebFiling or software. |

|

Confirmation Statement |

File Confirmation Statement |

All LTDs |

File CS01 online to Companies House, updating shareholder and director information. |

Key Deadlines For Claiming Your VAT Refund

If your business is VAT-registered in the UK, you must submit returns four times a year. Each quarter has a strict filing and payment deadline. Here’s a clear breakdown of the VAT return periods and due dates you need to track:

|

VAT Return Period |

Filing Deadline |

Details |

|

1st January – 31st March |

7th May |

VAT return for Q1 must be submitted by 7th May. |

|

1st April – 30th June |

7th August |

VAT return for Q2 must be submitted by 7th August. |

|

1st July – 30th September |

7th November |

VAT return for Q3 must be submitted by 7th November. |

|

1st October – 31st December |

7th February (following year) |

VAT return for Q4 must be submitted by 7th February of the following year. |

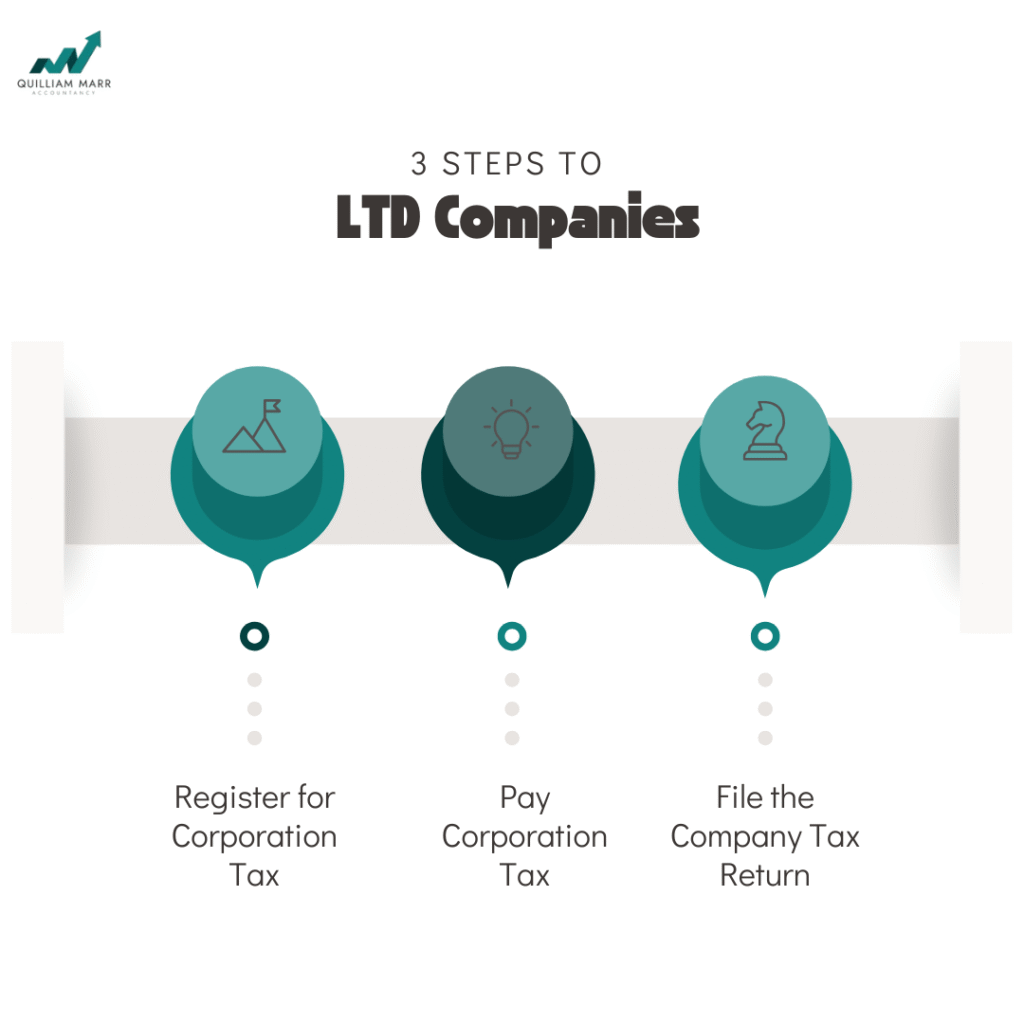

Corporation Tax Deadlines for LTD Companies

Every UK limited company must register, pay, and file Corporation Tax on time to stay compliant with HMRC rules. Missing deadlines can lead to fines and interest charges. Here’s a step-by-step breakdown of the key Corporation Tax deadlines every LTD must follow:

Step 1: Register for Corporation Tax

Deadline: Within 3 months of starting business activity (not just incorporation).

What counts as business activity?

- Selling your first product or service

- Advertising or marketing your business

- Hiring employees

- Renting an office or workspace

How it works now:

When a company incorporates, it is automatically registered for Corporation Tax. HMRC will send your Unique Taxpayer Reference (UTR) and details of your Corporation Tax responsibilities to the registered office.

Why it matters: HMRC does not send regular reminders unless your company is registered. Failing to register can result in late-filing penalties.

Step 2: Pay Corporation Tax

Deadline: 9 months and 1 day after your accounting period ends.

Example:

- Accounting period ends: 31 December 2025

- Payment deadline: 1 October 2026

How to pay:

- Log in to your HMRC business tax account

- Pay by bank transfer, Direct Debit, or debit/credit card

- Keep proof of payment for your records

Consequences of late payment: HMRC charges interest from the due date. Repeated late payments may also affect your company’s compliance history.

Tip: Set internal reminders at the 6-month and 8-month mark after your year-end to prepare cash flow for payment.

Step 3: File the Company Tax Return (CT600)

Deadline: 12 months after the end of your accounting period.

What you need to file:

- The CT600 form (main return)

- Full statutory accounts (with notes)

- Tax computations showing profit calculations

How to file:

- Submit via HMRC’s online service or commercial accounting software

- Many businesses use an accountant, but filing can be done independently with the right tools

Do not confuse deadlines:

- Payment is due 9 months + 1 day after year-end

- Filing is due 12 months after the year-end

Penalties for late filing:

- 1 day late → £100 fine

- 3 months late → another £100

- 6 months late → HMRC estimates tax and adds 10% surcharge

- 12 months late → further 10% surcharge

Tip: File early. You can amend a CT600 up to 12 months after submission if figures change.

Companies House Filing Requirements for LTD Companies

Alongside HMRC obligations, every limited company in the UK must also file annual accounts and confirmation statements with Companies House. These filings keep your company’s public record up to date, and missing them can lead to heavy penalties or even being struck off. Here’s what you need to know:

Step 1: File Annual Accounts

Deadline: Within 9 months of your accounting reference date (ARD).

First-year LTD companies get up to 21 months from incorporation to submit accounts.

What to include in annual accounts:

- Balance sheet showing assets, liabilities, and equity

- Profit and Loss Statement

- Notes to the accounts

- Director’s report (for medium and large companies)

How to file: Submit online using Companies House WebFiling.

If your company qualifies as a micro-entity, you can file simpler accounts.

Late filing penalties:

- Missed once: fine applies

- Missed two years in a row: penalty doubles

- Dormant companies must file accounts too

Step 2: File the Confirmation Statement

Deadline: Once a year, within 14 days of your incorporation anniversary (or last statement filed).

What the statement confirms:

- Registered office address

- SIC code (Standard Industrial Classification)

- Director and secretary details

- Shareholder information

- Persons with Significant Control (PSCs)

How to file: Online via Companies House WebFiling (£13 fee). Filing by post costs £40.

Failure to file:

- Companies House may strike your business off the register

- Directors risk disqualification

Tip: Keep a record of shareholder changes, new directors, or PSC updates during the year. This makes completing your confirmation statement quick and accurate.

What Should You Do Before the End of the Tax Year 2025/26?

As the tax year draws to a close, it’s the best time to review your finances and make smart moves that can reduce your tax bill, boost savings, and simplify filing. Here are some essential steps to take before 5 April:

1. Assess Tax Planning Opportunities

You have more control over your taxes than you think. Planning can help you hold on to more of your hard-earned money. Start by reviewing your income, expenses, and potential reliefs.

2. Maximise Pension Contributions

Pension payments are one of the best tax-saving tools in the UK.

You can contribute up to 100% of your earnings, capped at £40,000 annually. When you contribute, the government gives you an automatic 20% tax top-up. If you’re a higher or additional rate taxpayer, you can claim back even more—up to 45% in total tax relief.

It doesn’t end there. Pension contributions can reduce the High-Income Child Benefit Charge if you earn over £50,000. That’s a win-win.

3. Use Your ISA Allowance Wisely

Don’t miss your £20,000 annual ISA limit. An ISA lets you save or invest tax-free, whether in a Cash ISA, Stocks & Shares ISA, or a blend of both.

It’s flexible, tax-efficient, and you won’t pay income tax or capital gains tax on returns. If you’ve been putting it off, now’s the time to act.

4. Secure Your Child’s Financial Future

Thinking long term? There are powerful tax-friendly ways to save for your children, too.

- Junior ISA: Save up to £9,000/year for each child with tax-free growth.

- Child’s Pension: Contribute up to £3,600 annually, and the government will add 20% in tax relief, just like adult pensions.

These small steps can build a significant nest egg for your child’s future.

5. Leverage Capital Gains Tax (CGT) Allowance

For 2025/26, the CGT annual exempt amount is £3,000. Sell assets like shares or property (that’s not your main home) within this allowance to avoid tax. Expect this allowance to shrink in future tax years—so act early. You can also transfer assets to an ISA or sell and rebuy within one to protect gains from future CGT.

6. Organise Your Financial Records

Don’t wait until the last minute. Gather your:

- Income statements

- Business expenses

- Receipts and invoices

- Pension and investment documents

A well-organised record saves you time and prevents costly mistakes.

7. Plan Your Tax Payments

Estimate your tax liability and start setting money aside now. Waiting until January or July could leave you financially stretched.

By planning, you avoid interest charges and maintain a healthy business cash flow.

8. File Your Tax Return On Time

Early preparation pays off. For the 2024/25 tax year:

- Paper returns are due by 31 October 2025

- Online returns must be submitted by 31 January 2026

For 2025/26, the respective deadlines will be 31 October 2026 (paper) and 31 January 2027 (online). Don’t risk late penalties and unnecessary stress. Filing early lets you fix errors, claim reliefs properly, and breathe easy.

What is the Significance of Income Tax Weeks in the UK?

The UK tax system doesn’t just work on years and months; it also follows weekly tax cycles. These “tax weeks” play a vital role in how PAYE (Pay As You Earn) income tax and National Insurance are calculated. Understanding them helps both employers and employees stay accurate with deductions and filings.

- Determining Tax Thresholds and Allowances:

Tax thresholds, such as the personal allowance and income tax bands, are set weekly. This ensures fair distribution of the annual limits across the 52-53 weeks of the tax year.

- Aligning Pay Periods with Weekly Payments:

For employees paid every week, tax weeks align with their pay periods. This ensures that tax and national insurance deductions align with their weekly earnings.

- Reporting PAYE Information:

Employers use tax weeks to report pay and deductions to HMRC through the Real Time Information (RTI) system. This allows for timely and accurate tax reporting.

- National Insurance Contributions (NICs):

NIC thresholds are calculated weekly. This ensures that National Insurance contributions are correctly deducted for each pay period, impacting entitlements to benefits like pensions.

By understanding the concept of income tax weeks, you can better navigate the tax landscape in the UK, ensuring accuracy in deductions and timely payments.

Dividends Taxes at What Rate?

Dividends in the UK are taxed differently from regular salary income. While your salary earnings fall under UK income tax, dividend income is taxed at separate rates based on your tax band. Understanding these UK dividend tax rates helps you plan payouts effectively and reduce your overall tax liability.

- Basic Rate taxpayers (20%): Dividends are taxed at 8.75%.

- Higher Rate taxpayers (40%): Dividends are taxed at 33.75%.

- Additional Rate taxpayers (45%): Dividends are taxed at 39.35%.

Everyone in the UK gets a £1,000 tax-free dividend allowance, meaning the first £1,000 of dividend income is tax-free. Any dividend income above this threshold will be taxed at the relevant rates. To stay compliant, make sure to declare dividends correctly in your Self Assessment tax return and keep track of your dividend income to ensure accurate tax filing and avoid unnecessary penalties.

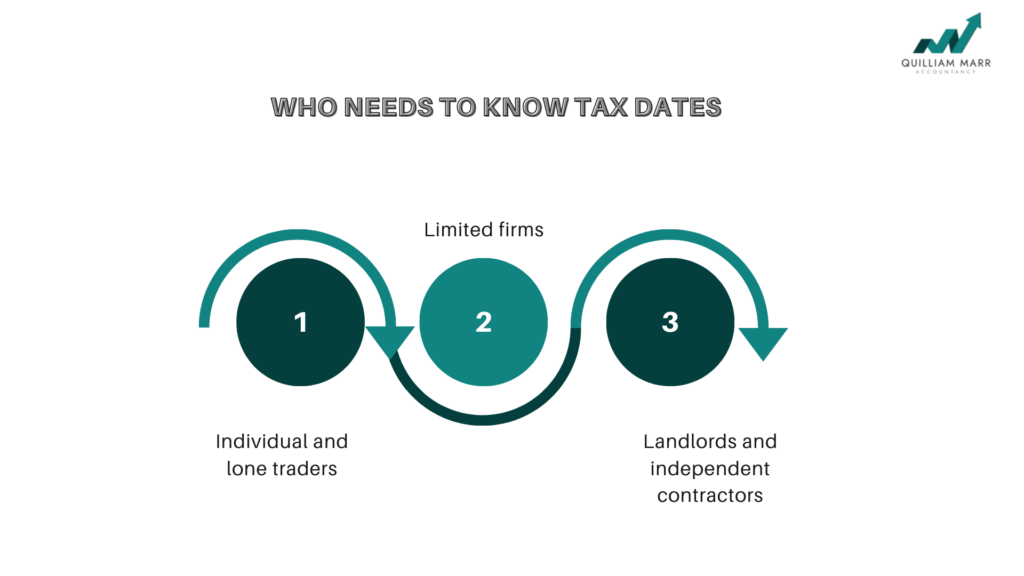

Who Needs to Know These Dates?

Tax deadlines aren’t just for accountants; they impact almost everyone. Whether you’re self-employed, running a limited company, or earning from property or investments, keeping track of these dates is essential to stay compliant and avoid fines.

- Individual and lone traders: Whether you work for yourself or someone else, you must submit a tax return if your income is untaxed or more than a certain level.

- Limited firms must pay corporation tax and disclose their earnings, matching their accounting cycles to the UK tax year.

- Landlords and independent contractors: These dates are crucial as income from freelancing or property rental has to be declared.

What Happens If You Miss a Tax Deadline?

Missing an HMRC tax deadline in the UK can lead to penalties, interest charges, and long-term financial consequences. Whether it’s your Self Assessment tax return, corporation tax, or VAT payment, delays can quickly become costly. Here’s a detailed breakdown of what happens if you don’t file or pay your taxes on time:

1. Immediate Late Filing Penalty

If you miss the deadline to submit your Self Assessment tax return, HMRC issues an instant penalty:

- £100 fixed fine – applied even if you owe no tax or have already paid your bill.

- This penalty applies the day after the tax deadline passes.

2. Increased Penalties Over Time

The longer you delay, the higher your fines:

- 3 months late → £10 per day fine (up to £900)

- 6 months late → Additional 5% of your tax bill or £300 (whichever is greater)

- 12 months late → Another 5% of your tax bill or £300 added

For serious cases (e.g., deliberate tax evasion), HMRC can charge up to 100% of the tax owed.

3. Interest on Late Payments

If you miss the payment deadline, HMRC charges daily interest on unpaid tax until the full amount is cleared. The current HMRC interest rate (2025) is around 7.75%, meaning the longer you delay, the more you’ll owe.

Tip: Always check the latest HMRC interest rates before paying.

4. Risk of Debt Collection and Enforcement

If you continue to ignore your tax bill:

- HMRC can deduct money directly from your wages or bank account

- They may instruct debt collection agencies

- In extreme cases, they can seize assets

This can severely damage your credit score and financial standing.

5. How to Avoid Penalties

To avoid HMRC fines and interest charges:

- Mark tax deadlines in advance

- File your Self Assessment online before the due date

- Set up a payment plan with HMRC if you can’t pay in full

- Keep accurate tax records for at least 5 years

How to Get Ready for Deadlines for Taxes

Staying ahead of UK tax deadlines doesn’t have to be stressful. With proper planning and the right tools, you can stay compliant, save money, and avoid last-minute filing issues. Here’s how to get organised:

- Sort financial information: Regularly monitor your income, expenses, and tax-related documents to simplify filing.

- Set reminders: Use calendar notifications or tax apps to track upcoming HMRC deadlines and avoid penalties.

- Seek professional guidance: If taxes feel overwhelming, consult an accountant or tax adviser to ensure accurate and timely submissions.

How QuillAmar Helps Limited Companies Handle Taxes with Ease

Managing HMRC rules and Companies House filings can feel complex, but QuillAmar makes it simple. From tax registration and payroll services to expense tracking and reminders, everything you need to stay compliant is in one place.

All-in-One Tax Support

- Register for VAT, PAYE, and Corporation Tax based on your company’s setup

- Auto-calculate and file VAT Returns, PAYE submissions, and Corporation Tax directly to HMRC

- Submit Confirmation Statements (CS01) online to Companies House

Smart Expense Tracking & Tax-Saving Tools

- Upload receipts and match them automatically with bank transactions

- Auto-categorised expenses help you claim more business costs and reduce tax bills

- Use built-in bookkeeping insights to stay compliant and boost tax efficiency

Automated Tax Planning & Reminders

- Tax pots automatically set aside money for Corporation Tax, VAT, and PAYE

- A personalised tax calendar ensures you never miss filing deadlines

- Receive alerts, reminders, and maintain organised records in one dashboard

HMRC-Recognised Payroll Software

- Run payroll for directors and up to 5 employees with ease

- Generate and store payslips, P45s, and P60s instantly

- File National Insurance, pensions, and student loan deductions directly to HMRC

Expert Help for LTD Companies

- Ask tax-related questions and get instant answers through QuillAmar’s AI tax assistant

- Access 24/7 support with links to official HMRC and Companies House guidance

- Tools are fully compliant with UK tax regulations

Professional Invoicing & Payments

- Create branded invoices with payment links and QR codes

- Accept card payments and track business income in real-time

Final Thought

Staying on top of the UK tax year isn’t just about avoiding penalties; it’s about taking control of your money and building financial confidence. With smart planning, timely filings, and the right tax advisors, you can turn tax deadlines into opportunities to save more and stress less.

And remember, you don’t have to do it all alone. Our professional accountants help UK limited companies handle taxes, payroll, and compliance with ease, so you can focus on growing your business while staying 100% compliant.

Frequently Asked Questions for dates for the tax year

Why does the UK tax year start in April instead of January?

The April start date goes back to historical changes in the UK calendar and has remained the standard tax cycle ever since.

What happens if I can’t pay my tax bill on time?

HMRC charges interest on unpaid amounts and may add late payment penalties. You can contact HMRC to set up a Time to Pay arrangement if you’re struggling.

Do limited companies follow the same tax year as individuals?

No. LTD companies follow their accounting periods. Corporation Tax deadlines depend on the company’s year-end, not the standard tax year.

Is it possible to change my company’s accounting period?

Yes, LTDs can apply to Companies House to shorten or extend their accounting period, but certain restrictions apply.

How do tax weeks affect employees?

Tax thresholds and NIC contributions are calculated weekly. If you’re paid weekly, your payslip is aligned with tax weeks to ensure accurate deductions.

Can I reduce my Corporation Tax legally?

Yes, by claiming allowable expenses, using R&D tax credits, making pension contributions, and utilising capital allowances.

What’s the difference between Corporation Tax and Income Tax?

Corporation Tax: Paid by LTD companies on profits.

Income Tax: Paid by individuals on personal earnings and untaxed income.

Are there penalties for missing Companies House filings?

Yes. Late accounts attract automatic fines, and repeated non-compliance can lead to your company being struck off the register.

Do self-employed people pay National Insurance separately?

Yes. Self-employed workers must pay Class 2 and Class 4 NICs through their Self Assessment return.

Can I get professional help if I’m unsure about tax deadlines?

Absolutely. Accountants and digital tools like Quillammar help you stay compliant, avoid penalties, and manage filings efficiently.