Introduction

Accounting stands as the cornerstone of the UK’s robust financial ecosystem, serving as the universal language of business that enables organisations to measure, communicate, and analyse their financial performance. From the smallest sole trader to the largest multinational corporation, accounting principles guide financial decisions that impact every aspect of the British economy.

This comprehensive guide explores the evolution of accounting from its ancient origins to its modern digital transformation in the UK. You’ll discover how this profession has adapted to economic changes, technological advances, and regulatory developments while maintaining its fundamental purpose: providing accurate, timely, and reliable financial information for decision-making.

Whether you’re considering a career in accounting, seeking to understand the profession’s requirements, or simply curious about how this essential field has shaped modern business practices, this article provides you with everything you need to know about accounting in the UK context.

What is Accounting?

Accounting is the systematic process of recording, measuring, and communicating financial information about a business entity to various stakeholders, including investors, creditors, management, and regulatory authorities. At its core, accounting serves as the financial reporting system that enables organisations to track their economic activities and make informed business decisions.

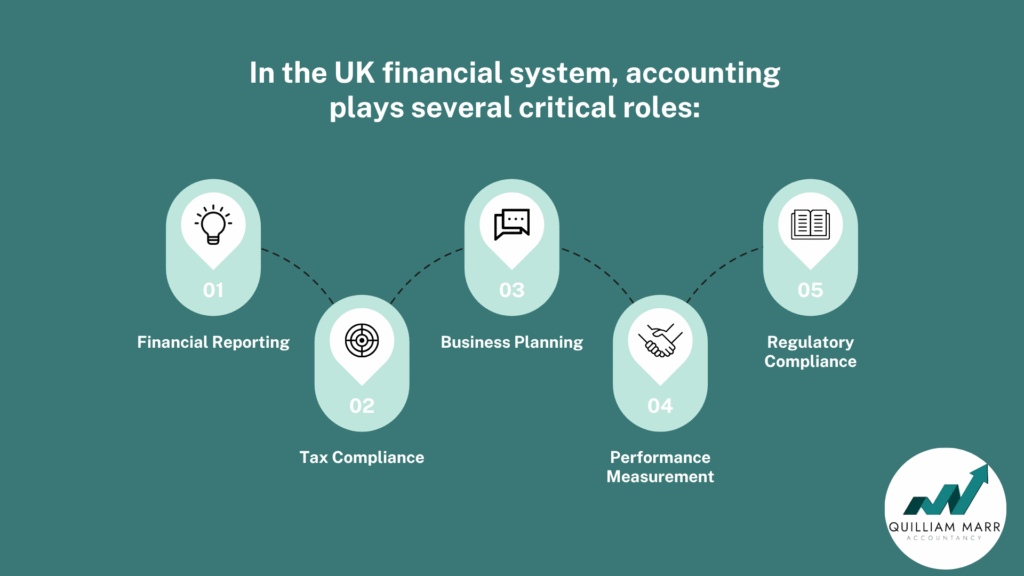

In the UK financial system, accounting plays several critical roles:

- Financial Reporting: Preparing statutory accounts and financial statements that comply with UK GAAP or International Financial Reporting Standards (IFRS)

- Tax Compliance: Ensuring businesses meet their obligations to HM Revenue & Customs (HMRC)

- Business Planning: Providing financial data for budgeting, forecasting, and strategic planning

- Performance Measurement: Analysing profitability, efficiency, and financial health

- Regulatory Compliance: Meeting requirements set by Companies House and other regulatory bodies

The importance of accounting extends beyond mere number-crunching. It provides the transparency and accountability that underpin investor confidence and economic stability in the UK market.

Brief History of Accounting

Global Origins and Early Practices

The roots of accounting stretch back over 7,000 years to ancient Mesopotamia, where clay tablets recorded transactions between merchants and traders. However, the foundation of modern accounting can be traced to 15th-century Italy, where Franciscan friar Luca Pacioli published “Summa de Arithmetica” in 1494, introducing the double-entry bookkeeping system that remains fundamental to accounting today.

UK Accounting History Timeline

Medieval Period (1066-1485)

- Introduction of basic record-keeping by Norman administrators

- Development of the Exchequer system for royal finances

- Early guild accounting practices in medieval towns

Renaissance and Early Modern Period (1485-1750)

- 1494: Luca Pacioli’s double-entry bookkeeping principles reach England

- 1500s-1600s: Merchant accounting practices develop in London

- 1720: South Sea Bubble highlights need for better financial reporting

Industrial Revolution Era (1750-1850)

- Growth of manufacturing requires more sophisticated cost accounting

- Railway boom creates demand for professional accountants

- Development of partnership and company accounting structures

Professional Formation Period (1850-1900)

- 1854: Society of Accountants in Edinburgh founded (first professional body)

- 1880: Institute of Chartered Accountants in England and Wales (ICAEW) established

- 1885: Society of Incorporated Accountants and Auditors formed

20th Century Developments (1900-2000)

- 1929: Stock market crash leads to enhanced auditing requirements

- 1948: Companies Act introduces mandatory audit requirements

- 1970: Accounting Standards Steering Committee established

- 1990: Financial Reporting Council (FRC) created

Modern Era (2000-Present)

- 2005: UK adopts International Financial Reporting Standards (IFRS) for listed companies

- 2013: New UK GAAP based on FRS 102 introduced

- 2016: Brexit considerations impact accounting standard adoption

- 2020s: Digital transformation and AI integration

Influence of Industrial Revolution and Corporate Laws

The Industrial Revolution fundamentally transformed UK accounting practices. The growth of large-scale manufacturing, railway companies, and joint-stock companies created unprecedented demand for professional accountants who could manage complex financial structures and provide reliable information to investors.

The Companies Act of 1862 was pivotal in establishing limited liability companies, while subsequent acts in 1900, 1929, and 1948 progressively strengthened accounting and auditing requirements. These legal frameworks established the foundation for modern corporate governance and financial reporting standards that continue to guide UK accounting practice today.

Evolution of Accounting & UK Standards

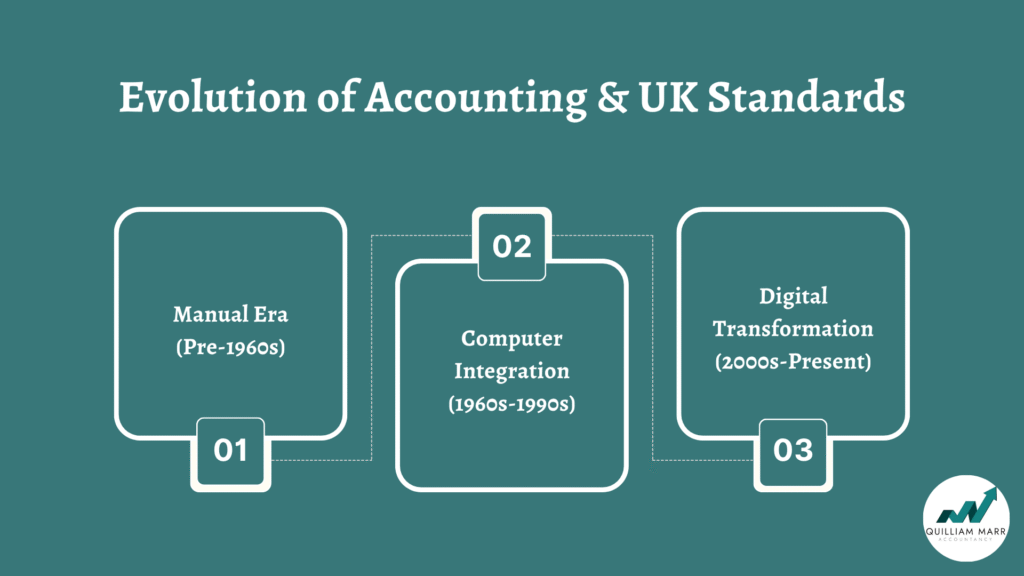

From Manual Bookkeeping to Digital Systems

The transformation of UK accounting from manual ledger books to sophisticated digital platforms represents one of the most significant changes in the profession’s history. This evolution has occurred in several distinct phases:

Manual Era (Pre-1960s)

- Handwritten ledgers and journals

- Mechanical adding machines and calculators

- Carbon paper for duplicate records

Computer Integration (1960s-1990s)

- Introduction of mainframe accounting systems

- Personal computer adoption in the 1980s

- Spreadsheet software revolutionises financial modelling

Digital Transformation (2000s-Present)

- Cloud-based accounting software (Xero, QuickBooks, Sage)

- Real-time financial reporting capabilities

- Integration with banking and payment systems

- Mobile accessibility for remote working

Development of UK Accounting Standards

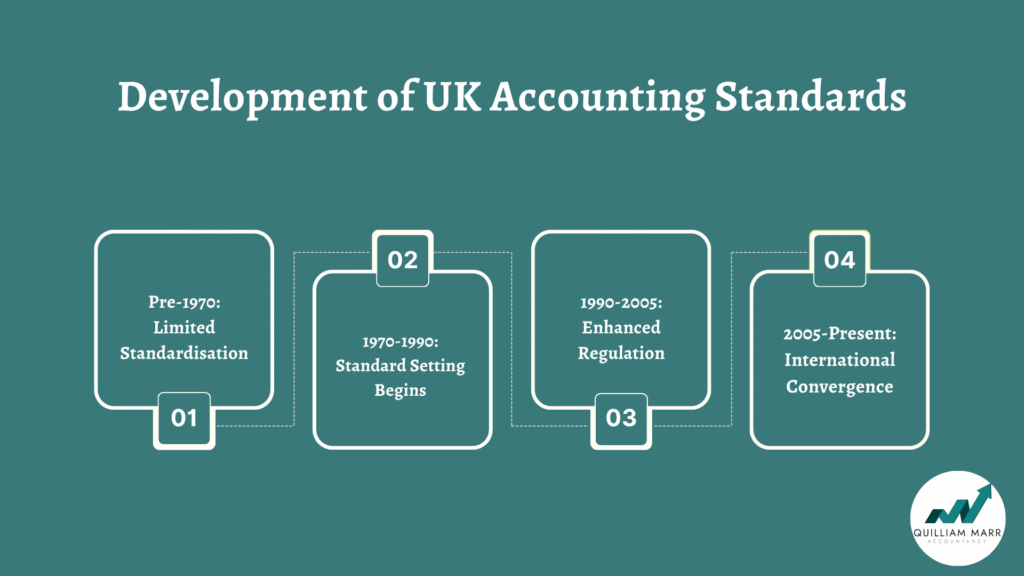

The evolution of UK accounting standards reflects the nation’s commitment to transparency, consistency, and international alignment:

Pre-1970: Limited Standardisation

- Accounting practices varied significantly between companies

- Professional judgement guided most decisions

- Limited regulatory oversight

1970-1990: Standard Setting Begins

- 1970: Accounting Standards Steering Committee established

- 1976: First Statement of Standard Accounting Practice (SSAP) issued

- 1982: Introduction of Financial Reporting Standards (FRS)

1990-2005: Enhanced Regulation

- 1990: Financial Reporting Council (FRC) created as independent regulator

- 1993: Financial Reporting Review Panel established

- Development of comprehensive UK GAAP framework

2005-Present: International Convergence

- 2005: EU-listed companies adopt IFRS mandatorily

- 2015: New UK GAAP based on FRS 102 for smaller entities

- 2021: UK-adopted international accounting standards post-Brexit

UK GAAP vs IFRS Framework

The UK operates a tiered approach to accounting standards:

UK-Adopted International Accounting Standards

- Apply to UK-listed companies

- Based on IFRS with UK-specific amendments

- Maintained by the UK Endorsement Board post-Brexit

FRS 102 (UK GAAP)

- Simplified standard for smaller entities

- Based on IFRS for SMEs with UK modifications

- Reduces compliance burden for private companies

FRS 105 (Micro-Entity Standard)

- Ultra-simplified reporting for very small companies

- Minimum disclosure requirements

- Available for companies meeting size criteria

This framework ensures that UK accounting standards remain internationally comparable while addressing the specific needs of British businesses. If your business needs guidance on which standards apply, you can find expert assistance through our small business accountants directory.

Modern Accounting Profession in the UK

Types of Accounting Roles

The modern UK accounting profession encompasses diverse specialisations, each requiring specific skills and expertise:

Financial Accounting

- Preparation of statutory accounts and financial statements

- Compliance with UK GAAP/IFRS requirements

- Management of accounts receivable/payable

- Month-end and year-end reporting processes

Management Accounting

- Budget preparation and variance analysis

- Cost accounting and pricing decisions

- Performance measurement and KPI development

- Strategic financial planning and analysis

Audit and Assurance

- Statutory audits for companies above certain thresholds

- Internal audit and risk assessment

- Due diligence for mergers and acquisitions

- Regulatory compliance reviews

Tax Accounting

- Corporation tax compliance and planning

- VAT returns and advisory services

- Personal tax for high-net-worth individuals

- International tax structuring

Forensic Accounting

- Financial investigation and fraud detection

- Litigation support and expert witness services

- Asset recovery and insolvency procedures

- Regulatory investigation assistance

For businesses seeking specialised tax expertise, our network includes qualified business tax consultancy professionals across the UK.

Key Skills for Modern Accountants

Technical Competencies

- Proficiency in accounting software (Sage, Xero, QuickBooks, SAP)

- Understanding of UK tax legislation and HMRC requirements

- Financial statement preparation and analysis

- Regulatory compliance knowledge

Digital and Analytical Skills

- Data analytics and business intelligence tools

- Excel advanced functions and financial modelling

- Cloud computing and remote collaboration platforms

- Process automation and workflow optimisation

Soft Skills and Professional Attributes

- Strong communication and presentation abilities

- Critical thinking and problem-solving skills

- Attention to detail and accuracy

- Time management and deadline adherence

- Ethical conduct and professional integrity

Technology Integration and Future Skills

The digital transformation of accounting has accelerated significantly, particularly following the COVID-19 pandemic. Modern accountants must adapt to:

Artificial Intelligence and Machine Learning

- Automated data entry and transaction categorisation

- Predictive analytics for financial forecasting

- Risk assessment and fraud detection algorithms

- Intelligent report generation

Blockchain and Cryptocurrency

- Understanding of distributed ledger technology

- Cryptocurrency accounting and taxation

- Smart contract implications for financial reporting

- Digital asset valuation methodologies

Environmental, Social, and Governance (ESG) Reporting

- Sustainability accounting and reporting

- Carbon footprint measurement and reporting

- Social impact assessment

- Governance framework compliance

Businesses requiring modern technological expertise can access our directory of accounting firms near me to find qualified professionals.

Accounting Qualifications & Certifications

Top Accounting Bodies in the UK

The UK accounting profession is regulated by several prestigious professional bodies, each offering distinct pathways to qualification:

Institute of Chartered Accountants in England and Wales (ICAEW)

- Founded: 1880

- Members: Over 180,000 worldwide

- Focus: General accounting, audit, and business advisory

- Qualification: Associate Chartered Accountant (ACA)

- Recognition: Considered the most prestigious UK qualification

Association of Chartered Certified Accountants (ACCA)

- Founded: 1904

- Members: Over 240,000 globally

- Focus: International accounting and finance

- Qualification: ACCA qualification leading to FCCA membership

- Recognition: Strong international presence and recognition

Chartered Institute of Management Accountants (CIMA)

- Founded: 1919

- Members: Over 110,000 worldwide

- Focus: Management accounting and strategic business management

- Qualification: Chartered Global Management Accountant (CGMA)

- Recognition: Specialises in business strategy and management accounting

Chartered Institute of Public Finance and Accountancy (CIPFA)

- Founded: 1885

- Members: Over 14,000

- Focus: Public sector accounting and finance

- Qualification: CIPFA qualification

- Recognition: Exclusively for public sector financial management

ACCA vs CIMA vs ICAEW: Key Differences

| Aspect | ACCA | CIMA | ICAEW (ACA) |

|---|---|---|---|

| Duration | 3-4 years part-time | 3-4 years part-time | 3-5 years (training contract) |

| Entry Requirements | 2 A-levels or equivalent | 2 A-levels or equivalent | Degree preferred |

| Exam Structure | 13 papers (4 levels) | 12 papers (3 levels) | 15 papers (3 levels) |

| Work Experience | 36 months relevant experience | 36 months relevant experience | Training contract required |

| Focus Areas | Financial accounting, audit, tax | Management accounting, strategy | General practice, audit emphasis |

| Career Pathways | Public practice, industry, consultancy | Management roles, consultancy | Public practice, corporate finance |

| Global Recognition | Excellent international recognition | Strong in management accounting | Primarily UK-focused but respected globally |

| Salary Expectations | £45,000-£65,000 newly qualified | £50,000-£70,000 newly qualified | £50,000-£70,000 newly qualified |

How to Become an Accountant in the UK

Step 1: Educational Foundation

- Academic Route: Degree in accounting, finance, or related field

- Non-Graduate Route: A-levels or equivalent qualifications

- Mature Student Route: Recognition of prior learning and experience

Step 2: Choose Your Qualification Path

- ACCA: Flexible study options, strong international recognition

- ICAEW (ACA): Requires training contract, prestigious reputation

- CIMA: Management accounting focus, strategic business emphasis

- AAT: Foundation qualification, pathway to higher qualifications

Step 3: Gain Practical Experience

- Training Contracts: 3-year programmes with approved employers

- Relevant Experience: Accounting roles in practice or industry

- Continuous Professional Development: Ongoing learning requirements

Step 4: Professional Registration

- Complete examination requirements

- Fulfill practical experience obligations

- Demonstrate ethical and professional competence

- Apply for membership with chosen professional body

Step 5: Specialisation and Career Development

- Choose specialisation area (audit, tax, advisory, management accounting)

- Pursue additional qualifications or certifications

- Develop industry expertise and client relationships

- Consider partnership or senior management opportunities

For those seeking entry-level opportunities, our small business tax advisor network offers excellent starting positions.

Modern Job Requirements & Career Path

Skills in Demand for Modern Accounting Jobs UK

The accounting profession in 2024 demands a blend of traditional technical skills and modern digital competencies:

Essential Technical Skills

- Financial Reporting: Preparation of statutory accounts under UK GAAP/IFRS

- Tax Compliance: Corporation tax, VAT, and personal tax expertise

- Audit and Assurance: Risk assessment and compliance verification

- Management Accounting: Budgeting, forecasting, and performance analysis

Digital Transformation Skills

- Cloud Accounting Platforms: Xero, QuickBooks Online, Sage Business Cloud

- Data Analytics: Excel Power BI, Tableau, SQL for financial analysis

- Automation Tools: Process automation and workflow optimisation

- Artificial Intelligence: Understanding AI applications in accounting

Emerging Competencies

- ESG Reporting: Environmental, social, and governance compliance

- Cryptocurrency Accounting: Digital asset valuation and reporting

- Blockchain Technology: Understanding distributed ledger implications

- Cybersecurity Awareness: Data protection and financial security protocols

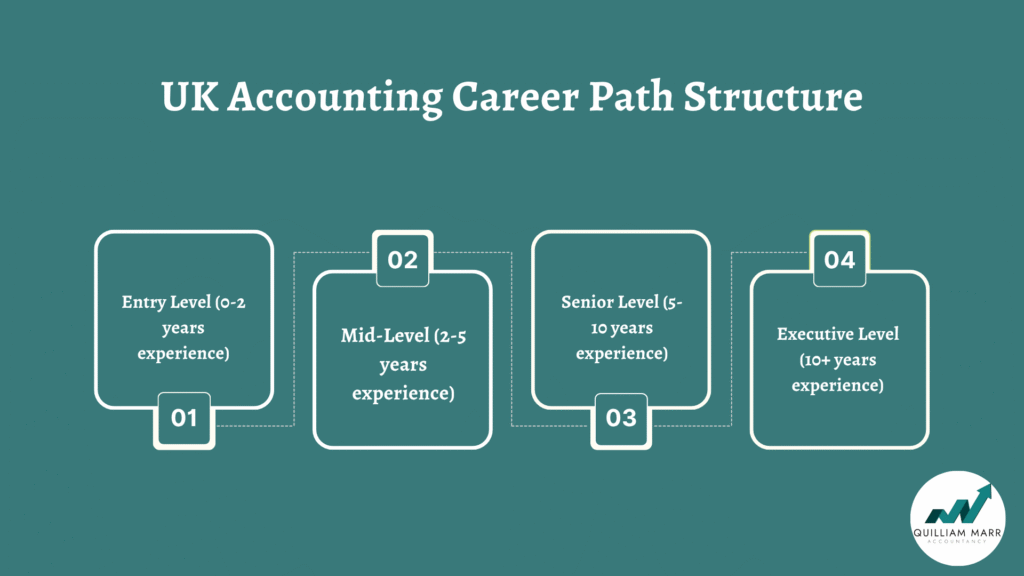

UK Accounting Career Path Structure

Entry Level (0-2 years experience)

- Trainee Accountant: £20,000-£25,000

- Accounts Assistant: £18,000-£22,000

- Junior Audit Associate: £22,000-£28,000

- Tax Trainee: £20,000-£26,000

Mid-Level (2-5 years experience)

- Semi-Senior Accountant: £28,000-£35,000

- Senior Accountant: £35,000-£45,000

- Audit Senior: £32,000-£42,000

- Tax Senior: £30,000-£40,000

Senior Level (5-10 years experience)

- Accounting Manager: £45,000-£60,000

- Senior Manager/Assistant Director: £55,000-£75,000

- Tax Manager: £50,000-£70,000

- Financial Controller: £60,000-£80,000

Executive Level (10+ years experience)

- Finance Director: £80,000-£120,000

- Partner (Public Practice): £100,000-£300,000+

- CFO: £120,000-£200,000+

- Managing Director: £150,000-£400,000+

Industry Specialisations and Opportunities

Public Practice

- Big Four Firms: Deloitte, PwC, EY, KPMG

- Mid-Tier Firms: BDO, Grant Thornton, RSM

- Local Practices: Specialising in SME advisory services

Corporate and Industry

- Financial Services: Banking, insurance, investment management

- Manufacturing: Cost accounting and operational efficiency

- Technology: Fintech, software companies, digital transformation

- Healthcare: NHS finance, private healthcare accounting

- Real Estate: Property development and investment accounting

Specialised Services

- Forensic Accounting: Investigation and litigation support

- Insolvency: Business recovery and liquidation procedures

- Corporate Finance: M&A, valuations, and capital raising

- Consultancy: Business improvement and transformation projects

For career opportunities across different regions, explore our comprehensive directory of accounting firms near me in the UK.

Future Trends and Salary Expectations

Market Outlook 2024-2030

- Growing Demand: Increased complexity of regulations and reporting requirements

- Skills Premium: Higher salaries for professionals with digital and analytical skills

- Remote Working: Flexible working arrangements becoming standard

- Specialisation Value: Premium for expertise in emerging areas (ESG, crypto, AI)

Regional Salary Variations

- London: 20-30% premium over national averages

- Manchester/Birmingham: 10-15% above national averages

- Scotland/Wales: Generally in line with national averages

- Regional Centres: Competitive salaries with lower living costs

Educational Videos and Resources

To complement your learning journey, here are essential educational videos covering key aspects of accounting:

History of Accounting

- History of Accounting and Current Trends – Learn Accounting (5:48)

- The Finance Storyteller: History of Accounting – Overview of accounting development (4:06)

- A Brief History of Accounting – AccountingCPD (2:18)

Modern Accounting Careers

- What to Do with Accounting Degree – Edspira (4:45)

- Is Becoming An Accountant Worth It? – Shane Hummus (8:51)

- Skills Needed for Accounting Job – Edspira (3:54)

UK Qualifications

- CIMA VS ACA VS ACCA – Which Qualification? – CRAIGO (11:00)

- How to Become an Accountant UK – Poppy Dontree (11:51)

- ACCA vs ICAEW vs CIMA Explained – Dominic Morgan ACA (2:54)

Practical Tools and Calculators

To support your accounting journey, utilise these essential calculation tools:

- Capital Gains Tax Calculator – Calculate CGT obligations accurately

- Dividend Calculator – Determine dividend tax implications

- Self Employment Tax Calculator UK – Plan your tax liabilities

- Payroll Tax Calculator – Manage employment tax calculations

- Loan Repayment Calculator – Plan business financing

Conclusion

The accounting profession in the UK has undergone remarkable transformation from its medieval origins to its current position as a cornerstone of the modern economy. Today’s accountants serve not merely as record-keepers but as strategic advisors, technology innovators, and guardians of financial integrity.

The path to becoming a qualified accountant in the UK offers multiple routes, from the internationally recognised ACCA qualification to the prestigious ICAEW ACA designation and the management-focused CIMA qualification. Each pathway provides unique opportunities for career development and specialisation in an increasingly diverse and dynamic profession.

As we look toward the future, the integration of artificial intelligence, blockchain technology, and sustainability reporting will continue to reshape accounting practice. However, the fundamental principles of accuracy, integrity, and professional competence remain unchanged. The most successful accounting professionals will be those who combine strong technical knowledge with digital fluency and strategic thinking capabilities.

Whether you’re embarking on an accounting career or seeking to advance your existing expertise, the UK accounting profession offers unparalleled opportunities for professional growth, financial reward, and meaningful contribution to business success.

For personalised guidance on your accounting journey or to find qualified professionals for your business needs, explore our comprehensive directory of accounting services across the UK.

Key Takeaways

- Accounting has evolved from ancient record-keeping to a sophisticated profession driving modern business decisions

- The UK operates a tiered approach to accounting standards, balancing international alignment with domestic needs

- Multiple qualification pathways (ACCA, ICAEW, CIMA) offer different specialisations and career opportunities

- Modern accountants require both traditional technical skills and emerging digital competencies

- The profession offers excellent career progression with competitive salaries across various industries and regions

Further Reading and Professional Development

- ICAEW Insights: Professional development resources and industry trends

- ACCA Global: Career guidance and qualification information

- CIMA: Management accounting insights and career development

- Financial Reporting Council: UK accounting standards and regulatory updates

This comprehensive guide provides the foundation for understanding accounting in the UK context. Whether you’re pursuing professional qualifications or seeking accounting services for your business, the resources and information provided will support your journey toward accounting excellence.