The “best” accountant for dentists varies depending on individual needs, goals, and practice size. Whether you’re an associate or a practice owner, choosing the right financial expert can make a huge difference in profitability and peace of mind.

Several firms are well-known for their expertise in dental accounting, including Smith Coffey, Alexander & Co, DJH Mitten Clarke, Morris Crocker, and Lovewell Blake. These professionals understand the numbers behind a successful dental practice.

In this guide, we’ve listed some of the top accountants for dentists in 2025 so you can find the right partner to support your practice, boost growth, and simplify your financial journey.

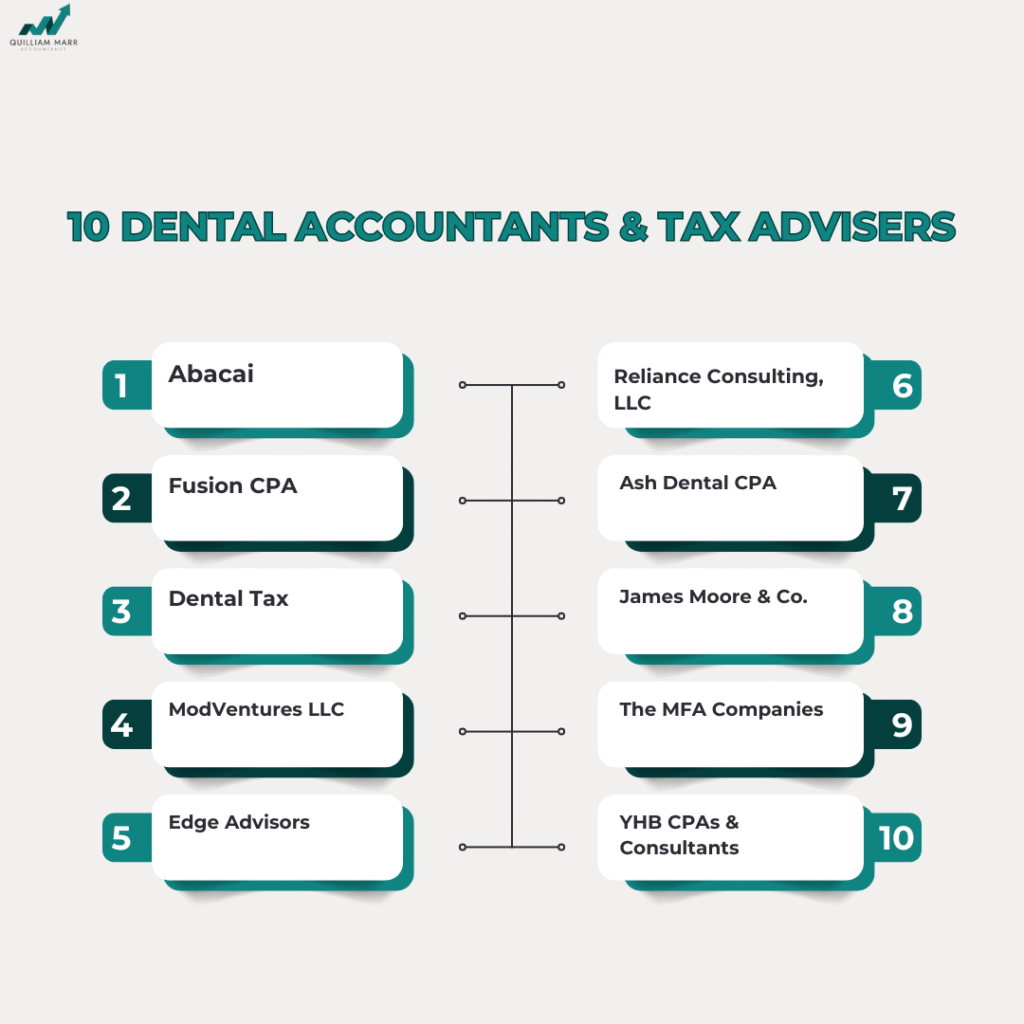

Top 10 Dental Accountants & Tax Advisers

1. Abacai

Abacai is a UK-based boutique accounting firm offering specialized support to dental and healthcare professionals. Known for its personalized and proactive approach, Abacai focuses on helping practices scale with confidence by providing both strategic and operational financial services. Their team blends expert financial insight with deep sector understanding, making them a go-to for UK-based dentists seeking tailored advice beyond standard compliance.

- Location: London, UK

- Clutch Rating: 5.0

- Services: Accounting, fractional CFO, finance & accounting outsourcing (FAO)

- Best For: Dental practices seeking personalized UK-based support

2. Fusion CPA

Fusion CPA has earned a stellar reputation in the US for its innovative and data-driven accounting services. With a strong focus on dental and medical professionals, they offer a range of services, from daily bookkeeping to high-level strategic planning. Their cloud-based systems and forward-thinking approach make them an ideal fit for practices seeking to modernize their financial operations.

- Location: Atlanta, Georgia, USA

- Clutch Rating: 5.0

- Services: Bookkeeping, tax planning, CFO consulting

- Best For: Dental clinics ready to scale with modern, tech-enabled solutions

3. Dental Tax

As the name suggests, Dental Tax is a Canada-based accounting firm that works exclusively with dentists. Their laser-like focus on dental practices provides them with unmatched industry insight, enabling clients to navigate everything from tax filings to practice transitions. Their service is renowned for being highly personalized and tailored to the specific needs of dental professionals in Canada.

- Location: Ottawa, Canada

- Clutch Rating: 5.0

- Services: Tax, accounting, practice transitions

- Best For: Canadian dentists wanting niche, dental-only accounting expertise

4. ModVentures LLC

ModVentures combines modern accounting tech with a strong client-focused approach. Although not exclusively dental, they work with several healthcare providers, including dental practices, offering scalable services like outsourced CFO, bookkeeping, and payroll. Their flexible pricing and remote support make them an excellent option for small to medium-sized clinics.

- Location: Tucson, Arizona, USA

- Clutch Rating: 5.0

- Services: Accounting, tax, outsourced CFO

- Best For: Growing practices that want virtual financial leadership

5. Edge Advisors

Edge Advisors is one of the few firms that go beyond accounting by offering full-spectrum support to dental practices—including recruitment, business transitions, and M&A advisory. With deep roots in the dental industry, they’re ideal for practice owners looking to expand, sell, or optimize operations in the US Midwest.

- Location: Wisconsin, USA

- Clutch Rating: 5.0

- Services: Dental accounting, transitions, recruiting

- Best For: Midwest dentists focused on growth, hiring, or practice sale

6. Reliance Consulting, LLC

Reliance Consulting provides comprehensive tax and accounting services specifically designed for medical and dental professionals. Their detail-oriented approach, combined with substantial industry knowledge, makes them a trusted partner for practice owners looking to maintain compliance while improving profitability.

- Location: Tampa, Florida, USA

- Clutch Rating: 5.0

- Services: Tax, accounting, payroll, business advisory

- Best For: Dentists seeking a full-service financial team in Florida

7. Ash Dental CPA

Ash Dental CPA works exclusively with dental professionals, providing accounting, tax, and consulting services throughout all stages of a practice’s lifecycle—from startup to sale. Their experience with practice acquisition and transitions makes them a valuable resource for dentists planning for growth or exit.

- Location: Massachusetts, USA

- Clutch Rating: 5.0

- Services: Tax, accounting, practice transitions

- Best For: Dentists buying, running, or selling a practice

8. James Moore & Co.

James Moore & Co. is a well-established accounting firm with a dedicated healthcare niche, including a focus on dental clients. Their tailored services and decades of experience make them especially helpful for practice owners seeking long-term financial strategy support, along with compliance.

- Location: Florida, USA

- Clutch Rating: 4.9

- Services: Accounting, audit, tax, business consulting

- Best For: Long-term financial growth and audit-ready practices

9. The MFA Companies

The MFA Companies offer high-level tax and business advisory services to help dental groups and private clinics scale effectively. They’re known for assisting practices to improve operational efficiency while planning for expansion or investment.

- Location: Massachusetts, USA

- Clutch Rating: 5.0

- Services: Tax, assurance, consulting

- Best For: Fast-growing dental businesses with complex needs

10. YHB CPAs & Consultants

YHB has been serving healthcare professionals for decades, offering reliable tax, audit, and consulting services. Their strong reputation stems from consistently delivering results and providing client-centred service, making them a trusted name in the dental industry, particularly in the Virginia region.

- Location: Virginia, USA

- Clutch Rating: 5.0

- Services: Tax, audit, financial planning

- Best For: Established dental practices seeking trustworthy long-term advisors

Key Considerations When Choosing the Best Accountant for Dentists

Choosing a dental accountant isn’t just about crunching numbers. It’s about finding someone who understands your industry, your challenges, and your goals. Here’s what to look for when selecting the best accountant for your dental practice.

1. Go for Dental Accounting Specialization

Not all accountants understand the complexities of dentistry. A dental tax specialist knows the ins and outs of NHS contracts, private billing, UDA valuations, and equipment deductions. Working with someone who speaks your language can save you time, money, and stress.

2. Look for Full-Spectrum Services

The ideal accounting firm for dentists should offer more than just bookkeeping. Tax planning, business structuring, payroll, practice sales, and long-term financial advice should be part of the package. The more tailored the services, the more value you’ll get.

3. Check Their Industry Experience

Ask how many dental clients they’ve worked with and how long they’ve been doing it. Experience in dental practice accounting means fewer surprises for you—and better strategies to handle industry-specific challenges.

4. Prioritize Clear Communication

Your accountant should be responsive, approachable, and easy to understand. Transparency in pricing and services is also key. Avoid firms that are vague about costs or avoid your questions.

5. Discuss Fees Upfront

Every dental practice has a budget. Make sure their fees align with yours—and that you’re clear on what’s included. Some offer fixed monthly packages; others bill by the hour. Choose what fits your cash flow best.

6. Ask for Recommendations

Word of mouth is powerful. Ask fellow dentists who they trust. Online reviews, testimonials, and Clutch ratings can also give you insight into how reliable and knowledgeable the accountant is.

Frequently Asked Questions

If you’re still unsure about hiring a dental accountant or what to expect, you’re not alone. Here are some of the most common questions dentists ask when searching for the right financial partner:

Do I need a specialist accountant for my dental practice?

Yes. A general accountant may not understand NHS contracts, UDA valuations, or the financial structure of a private practice. A dental accountant offers tailored advice that can improve tax efficiency and long-term profitability.

What services should a dental accountant offer?

At a minimum, bookkeeping, tax filing, and payroll. But the best accountants for dentists go further offering practice valuations, incorporation advice, retirement planning, and help with buying or selling your clinic.

How much does a dental accountant cost?

It varies. Some charge fixed monthly fees (ideal for budgeting), while others bill hourly. On average, UK dental accountants charge between £100 and £300 per month for basic services, with higher fees for complete financial management.

Can a dental accountant help grow my practice?

Absolutely. From identifying tax-saving opportunities to planning expansion, a good accountant becomes a strategic partner. Many also help with cash flow forecasting and profit optimization.

How do I verify an accountant’s experience with dentists?

Ask directly. Request to speak with existing dental clients or check online reviews. Sites like Quilliammar, LinkedIn, and Google Business often reveal how well they serve dental professionals.

Set Your Dental Practice Up for Financial Success!

Working with an accountant who truly understands the dental industry can make a world of difference. From UDA contracts to practice sales, specialist support ensures you stay compliant while growing profitably. At Quilliam Marr, we offer tailored financial services designed specifically for dentists, helping you manage your practice with confidence.

Ready to simplify your dental finances? Get in touch with Quilliam Marr today.