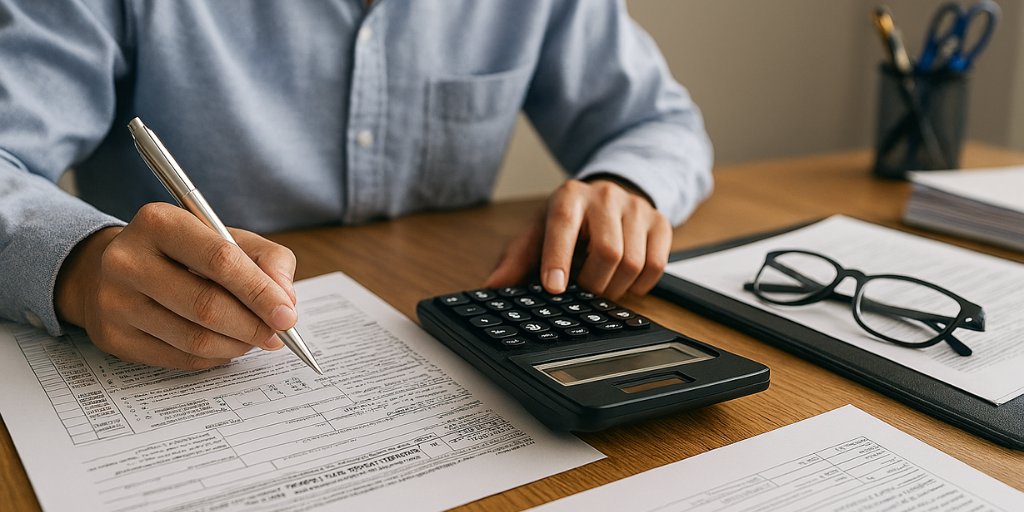

Accountants for SaaS companies in the UK specialize in managing subscriptions, revenue recognition, tax compliance, and growth-focused financial planning for software businesses.

Smart financial strategies built to scale your SaaS business with confidence.

Accountants for SaaS companies in the UK specialize in managing subscriptions, revenue recognition, tax compliance, and growth-focused financial planning for software businesses.

From First Invoice to First Million We’ve Got Your Numbers Covered

We learn about your SaaS model, goals, and financial challenges.

We design a tailored accounting and tax plan for your business.

Our experts handle bookkeeping, payroll, and compliance tasks seamlessly.

Get clear insights and data-driven reports to scale your SaaS confidently.

Accurate management of recurring revenue, expenses, and financial records to keep your books clean and investor-ready.

Specialized tax strategies for SaaS companies to minimize liabilities while staying fully compliant with UK regulations.

Detailed financial reports and cash flow forecasts to help you make smarter growth and investment decisions.

Reliable payroll processing for teams and contractors, ensuring on-time payments and full HMRC compliance.

Strategic financial advice and performance tracking to help you make confident, data-driven business decisions.

Identify and claim R&D tax incentives your SaaS business qualifies for to boost cash flow and reinvest in innovation.

Helping new software ventures set strong financial foundations and scale with confidence.

Managing complex transactions, subscriptions, and digital sales across multiple markets.

Supporting financial technology businesses with compliance, reporting, and tax optimization.

Simplifying accounting for agencies handling multiple clients, projects, and revenue streams.

Providing full accounting support for developers and IT service providers managing recurring contracts.

98% Client Retention Rate SaaS founders stay with us because we deliver clarity and consistency.

At quilliammarr.co.uk, we’re a team of qualified accountants, certified tax advisors, and experienced business consultants dedicated to helping you achieve financial success. With expertise in managing company tax accounts, HMRC business tax accounts, and providing tax account online services, we ensure seamless and efficient financial management tailored to your needs. Our dedicated team provides the following benefits to businesses and individuals across the UK.

Our robust security measures ensure the privacy and confidentiality of all client information, giving you peace of mind while working with our trusted tax accountants.

Strategic VAT planning helps optimize your tax position through: Identifying recoverable VAT Selecting optimal VAT schemes Structuring transactions efficiently

Stay compliant effortlessly with our system of timely alerts for HMRC business tax accounts and filings, ensuring you never miss a deadline and maintain perfect compliance records.

We provide personalized, flexible solutions for HMRC business tax accounts, ensuring your unique needs are met across the financial spectrum with detailed analytical insights.

Start with a free consultation to gain valuable insights from experienced tax accountants for strategic financial planning and decision-making. You don't need to do anything, just expert guidance.

Our qualified tax accountants are committed to delivering meticulous, client-focused services with a professional approach, customized to your specific business needs.

SaaS accounting involves complex areas like deferred revenue, subscriptions, and R&D credits. Specialized accountants understand these models and ensure accurate reporting and compliance.

We work with both. Whether you’re pre-revenue or scaling rapidly, we tailor accounting and tax strategies that fit your growth stage.

Yes. We identify qualifying projects, prepare documentation, and manage the claim process to help you secure R&D tax incentives efficiently.

We manage multi-currency transactions, global compliance, and reporting, ensuring your SaaS operations stay accurate and tax-efficient across borders.

Beyond Accounting Your Growth Partner at Every Stage

Dedicated accountants for UK gaming studios and developers, helping with royalties, R and D relief, and financial planning for creative success.

Professional accounting solutions for UK IT support firms, covering payroll, VAT, and scalable financial systems to match business growth.

Trusted accountants for UK fintech startups, combining compliance expertise with financial insights to support innovation and investor confidence.

Request a schedule for free consultation

3 embassy drive, Calthorpe road,

Birmingham, B15 1TR

+44 7961 090248

Info@quilliammarr.co.uk

Your trusted accountancy

partner. navigating financial

success together.

Quilliammarr is a UK-based firm providing expert accounting and financial solutions for businesses and individuals, backed by a team of qualified accountants, tax advisors, and business consultants.

Navigation

Contact Info

am providing my services as the Managing Partner and Tax Specialist. My expertise includes helping medium and small-scale businesses in their accountancy and legal requirements, business start-up support

am providing my services as the Managing Partner and Tax Specialist. My expertise includes helping medium and small-scale businesses in their accountancy and legal requirements, business start-up support

Expertise:

Accountancy

Legal Requirements

Business Start-Up Support

Payroll System

am providing my services as the Managing Partner and Tax Specialist. My expertise includes helping medium and small-scale businesses in their accountancy and legal requirements, business start-up support

am providing my services as the Managing Partner and Tax Specialist. My expertise includes helping medium and small-scale businesses in their accountancy and legal requirements, business start-up support

Expertise:

Accountancy

Legal Requirements

Business Start-Up Support

Payroll System

am providing my services as the Managing Partner and Tax Specialist. My expertise includes helping medium and small-scale businesses in their accountancy and legal requirements, business start-up support

am providing my services as the Managing Partner and Tax Specialist. My expertise includes helping medium and small-scale businesses in their accountancy and legal requirements, business start-up support

Expertise:

Accountancy

Legal Requirements

Business Start-Up Support

Payroll System

am providing my services as the Managing Partner and Tax Specialist. My expertise includes helping medium and small-scale businesses in their accountancy and legal requirements, business start-up support

am providing my services as the Managing Partner and Tax Specialist. My expertise includes helping medium and small-scale businesses in their accountancy and legal requirements, business start-up support

Expertise:

Accountancy

Legal Requirements

Business Start-Up Support

Payroll System

am providing my services as the Managing Partner and Tax Specialist. My expertise includes helping medium and small-scale businesses in their accountancy and legal requirements, business start-up support

am providing my services as the Managing Partner and Tax Specialist. My expertise includes helping medium and small-scale businesses in their accountancy and legal requirements, business start-up support

Expertise:

Accountancy

Legal Requirements

Business Start-Up Support

Payroll System

am providing my services as the Managing Partner and Tax Specialist. My expertise includes helping medium and small-scale businesses in their accountancy and legal requirements, business start-up support

am providing my services as the Managing Partner and Tax Specialist. My expertise includes helping medium and small-scale businesses in their accountancy and legal requirements, business start-up support

Expertise:

Accountancy

Legal Requirements

Business Start-Up Support

Payroll System