Small business accounting in the UK typically costs between £60 and £250 per month, but how do you know you’re not overpaying?. According to the Federation of Small Businesses, nearly 4 in 10 small business owners aren’t confident they’re getting fair value for what they’re spending.

And it’s not just about price, it’s about staying compliant, making smarter financial decisions, and protecting your time.

In this guide, you’ll discover what UK accountants charge, what’s included, and how to avoid unnecessary costs. Whether you’re just starting or reassessing your current setup, you’ll walk away with clarity, confidence, and cost-saving insights.

Why Accounting Matters for Small Businesses

Accounting is essential for small business success. It keeps you compliant with HMRC rules, helps track income and expenses, and supports better financial decisions. In the UK, failure to maintain accurate records can lead to penalties starting at £100.

According to Xero’s report, businesses that updated their books monthly were 3x more likely to grow revenue.

As Emily Coltman FCA, Chief Accountant at FreeAgent, explains in her expert commentary:

“Accounting isn’t just about ticking boxes for HMRC, it’s the financial language of your business. When you understand it, you gain control over your decisions, spending, and profitability.

| Did you know ?

Small businesses in the UK are responsible for nearly 99% of the private sector workforce? Yet, many spend a large chunk of their time just managing taxes!

|

What Services Are Included in Accounting?

Accounting isn’t just about crunching numbers, it’s a suite of structured services that help businesses stay compliant, organised, and financially sound. Below is a breakdown of the core services most UK accountants offer to small businesses.

-

Bookkeeping

Bookkeeping is the day-to-day tracking of income, expenses, invoices, and bank reconciliation. It forms the base for all financial reporting and decision-making.

Typical cost: £20–£40/hour or £100–£300/month depending on volume.

Example: A small design agency with 30–50 monthly transactions may pay around £200/month for regular bookkeeping through a cloud-based tool like Xero.

“Good bookkeeping isn’t just data entry, it’s insight delivery,” says Emma Rawson, Technical Officer at the Association of Taxation Technicians (ATT). “It shows you where money leaks happen and how to tighten your operations.”

-

Payroll

Payroll services manage employee salaries, PAYE tax deductions, National Insurance (NI), and HMRC submissions. It’s a legal requirement if you employ staff, even part-time.

Typical cost: £5–£10 per employee/month, plus setup fees.

Example: A retail business with 5 employees might pay around £50/month, including payslip generation, RTI filing, and pension contributions.

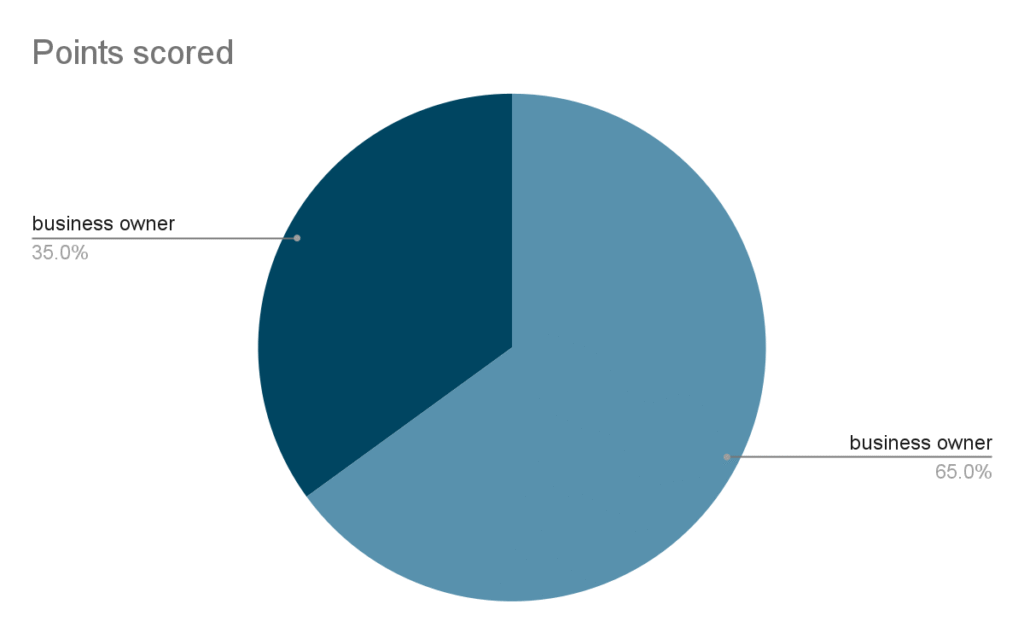

In a 2025 ICAEW Payroll Trends report, over 65% of small business owners said outsourcing payroll saved time and reduced errors compared to DIY methods.

-

VAT Returns

For VAT-registered businesses (earning over £90,000 annually), accountants handle quarterly VAT filings to HMRC, including input/output VAT reconciliation and compliance with Making Tax Digital (MTD) rules.

Typical cost: £50–£150 per return, or bundled in monthly packages.

Example: A small wholesale supplier that’s VAT-registered with variable cash flow might pay £100 per quarter to ensure accurate filing and avoid MTD penalties.

“VAT mistakes are one of the most common causes of HMRC investigations,” notes Glen Foster, former Director at Xero UK. “Regular filing with professional oversight is a safeguard, not a luxury.”

-

Year-End Accounts

These include the preparation and submission of annual accounts, Corporation Tax returns (CT600), and balance sheet summaries to Companies House and HMRC.

Typical cost: £750–£2,000+ depending on company size and complexity.

Example: A limited company with moderate turnover and one director may pay around £900/year for full year-end reporting and CT600 filing.

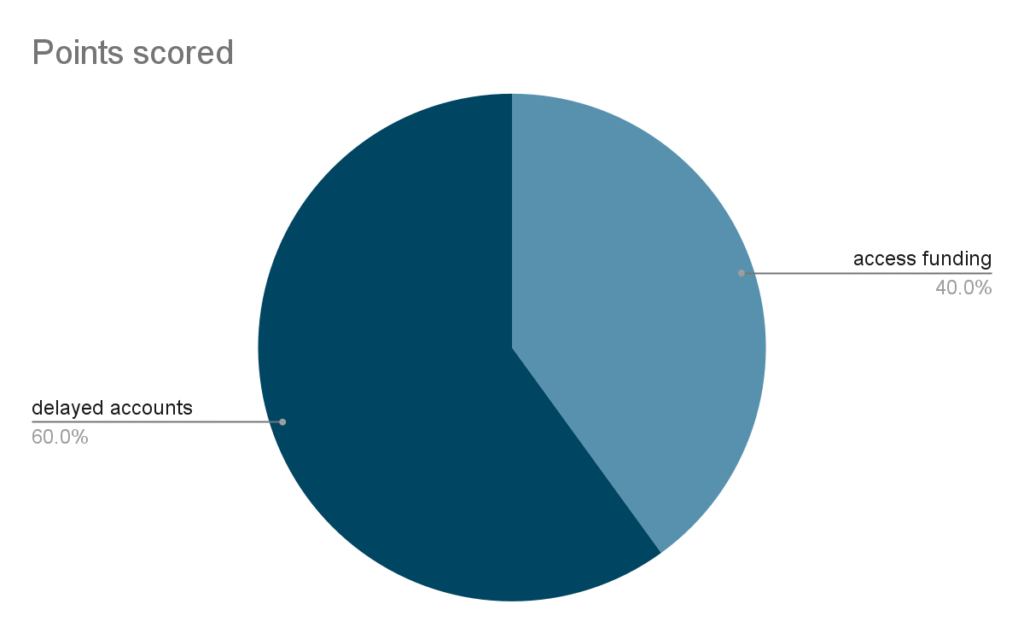

According to a UK Finance Study , small companies using structured year-end reviews were 40% more likely to access funding or credit compared to those with incomplete or delayed accounts.

-

Tax Planning & Advice

This service goes beyond filing, tax advisors help identifying allowable expenses, capital gains strategy, director salary/dividend optimisation, and future planning (like retirement, exit, or investment).

Typical cost: £150–£300/hour, or built into packages for regular clients.

Example: A tech startup planning to raise funding might hire an accountant to model different tax scenarios based on scaling revenue or hiring.

“Tax planning is where the real savings happen,” says Carl Reader, author of The Startup Coach. “It’s not about dodging tax, it’s about paying fairly and keeping more of what you earn.”

Accounting Cost Breakdown in the UK

| Service | Average Cost | Fixed/Hourly |

| Bookkeeping | £20–£40/hour | Hourly/Flexible |

| Self Assessment | £100–£300 | Fixed |

| Annual Accounts (Ltd Co) | £750–£2,500 | Fixed |

| VAT Returns | £50–£150/month | Monthly |

| Payroll | £5–£10 per employee/month | Monthly |

Note: Actual fees may vary based on the accountant’s experience, the complexity of your finances, and your business’s location.

Fixed Fee vs Hourly Accounting: What’s Right for Your Business?

When choosing a small business accountants, you’ll typically come across two pricing models: fixed fees and hourly rates. Each has its pros and cons, and the right choice depends on your business size, complexity, and stage of growth.

| Feature | Fixed Fee | Hourly Billing |

| Cost Predictability | High same amount monthly | Varies with time spent |

| Best For | Growing businesses needing regular help | Freelancers/startups with occasional needs |

| Scope of Work | Clearly defined services in a package | pay only for what you use |

| Budgeting | Easier to plan and allocate | Harder to predict monthly costs |

| Risk of Overpaying | Low, if needs are consistent | High, if time spent increases unexpectedly |

| Surprise Bills? | Rare (unless scope changes) | Possible, depending on time required |

What Factors Affect the Cost of Accounting?

The cost of accounting services for small businesses isn’t one-size-fits-all. It depends on several key factors that shape how much time, expertise, and attention your accountant needs to dedicate to your business. Understanding these can help you budget smarter and avoid paying for services you don’t need.

1. Business Size

The bigger your business, the more complex your financial needs and the higher the cost. A sole trader with basic income and expenses will need minimal support. In contrast, a growing limited company with employees, suppliers, and multiple revenue streams requires more attention, more time, and more in-depth financial reporting.

Example: A freelance writer may only need a £200/year tax return, while a retail shop with staff might pay £200+/month for full service.

2. Number of Transactions

More transactions = more bookkeeping work.

Every sale, purchase, bank transfer, or refund must be recorded and reconciled. Businesses with high-volume transactions naturally require more time from their accountant which increases fees.

Tip: Keep your receipts and invoices organised. It reduces your accountant’s workload and your bill.

3. Business Structure (Sole Trader vs Limited Company)

Sole traders usually pay less because their requirements are simpler, mostly just a Self Assessment tax return. Limited companies, however, are legally required to submit statutory accounts, Corporation Tax returns (CT600), and Companies House filings, all of which require professional support.

| Did you know?

A limited company must keep detailed financial records for at least 6 years; this alone justifies the need for expert help. |

4. Use of Accounting Software

Modern accounting software like Xero, QuickBooks, or FreeAgent can significantly reduce manual work. These tools automate invoicing, expense tracking, and bank reconciliation. If you’re using one, your accountant will likely offer a lower fee — or faster turnaround because the data is easier to manage.

Pro Tip: Ask your accountant which software they prefer. Using the same platform can lead to cost savings and faster service.

5. Frequency of Reporting

Do you need monthly reports? Weekly cash flow updates? Or just year-end accounts? The more often you require reporting, the more time your accountant spends maintaining your records and preparing insights which increases your fee.

For growing businesses, monthly reporting can help track performance, manage budgets, and prepare for funding but it does come at a cost.

Read More: Best Accountants for Growing Companies In UK

Hidden Costs to Watch Out For

Many small business owners focus only on the monthly or annual fee their accountant quotes but overlook the extra costs that can creep in unexpectedly. These hidden charges may not be obvious upfront but can impact your budget and lead to frustration down the line. Here are three common ones you should be aware of:

1. Late Filing Fees

Missing deadlines for HMRC or Companies House filings comes with automatic penalties. These aren’t accountant fees, but they result from delays in submitting your accounts or tax returns often due to poor communication or disorganised records. For example:

- Self Assessment late filing penalty: £100 (even if you owe no tax)

- Limited company accounts filed late: Up to £1,500 if more than six months overdue

| Quick Tip:

Stay in regular contact with your accountant, provide documents early, and track deadlines. |

2. Advisory Add-Ons

Basic packages often exclude tax planning, financial forecasting, or one-on-one advice. These services are incredibly useful but they can add up quickly when billed separately at hourly rates of £150–£300/hour.

Always check what’s included in your accounting package. If advisory calls, cash flow forecasts, or HMRC responses are extra, ask for those costs upfront.

3. Switching Accountants

Changing accountants isn’t always free or simple. If you’re switching mid-year, you might face:

- Data migration or software setup fees

- Duplicate charges during transition months

- Exit fees from your previous accountant (yes, some charge them)

Learn More: Best Accountants for Family Businesses in the UK

Tips to Reduce Accounting Costs

Reducing accounting expenses doesn’t mean cutting corners, it’s about working smarter. With the right tools and a clear understanding of your business needs, you can streamline financial processes, avoid overpaying, and still stay compliant with HMRC requirements. Here are practical ways to manage your accounting costs more efficiently:

- Automate routine tasks like invoicing, bank reconciliation, and expense tracking to minimise manual input.

- Use accounting software such as QuickBooks, Xero, or Zoho Books to streamline processes and reduce labour costs.

- Only hire for the services you actually need; avoid paying for full packages if you only require annual reporting.

- Bundle services like VAT returns, payroll, and bookkeeping to get package discounts from your accountant.

- Consider outsourcing instead of hiring in-house; it’s often more cost-effective for small businesses.

DIY Accounting vs. Professional Accountants for Limited Companies

As a limited company owner, one of the biggest decisions you’ll face is whether to handle your accounting yourself or hire a professional. Both options have their advantages and their risks.

What is DIY Accounting?

DIY (Do-It-Yourself) accounting means managing all your business’s finances on your own using tools like spreadsheets or accounting software (e.g., Xero, QuickBooks) without professional help.

What is a Professional Accountant?

A professional accountant is a trained and often certified expert (like a chartered accountant) who handles your business’s financial records, tax returns, compliance, and gives financial advice.

While DIY accounting may seem like a money-saving option, professional accountants provide expertise that can prevent costly mistakes and even uncover hidden tax savings. In this section, we’ll explore both approaches, weigh the pros and cons, and offer guidance on choosing the best fit for your business.

The DIY Accounting Approach

DIY accounting means managing your company’s finances without outside help. This typically involves using accounting software or spreadsheets for tasks like tracking income, recording expenses, and submitting tax returns.

Advantages

Cost Savings

Handling finances independently eliminates the cost of professional services.

Example: A small consultancy may only spend £30/month on software versus £200+ for an accountant.

Full Control

You stay closely connected to your company’s finances, building stronger financial awareness.

Tech Tools Help

Platforms like Xero, QuickBooks, and FreeAgent simplify key tasks such as invoicing, expense tracking, and VAT submissions.

Drawbacks

Time-Intensive

You may spend hours each week managing books, especially if your business involves lots of transactions.

Risk of Mistakes

Incorrect tax filings or missed deadlines can lead to HMRC fines.

Example: Late filings can incur penalties from £150 to £1,500 depending on delays.

Limited Expertise

DIYers might miss tax reliefs, fall short of compliance, or misinterpret new tax laws.

The Case for Professional Accountants

Professional accountants provide strategic support, ensure compliance, and help optimize tax outcomes.

Advantages

Expert Knowledge

Accountants understand tax codes, helping you reduce liabilities legally.

Example: One accountant saved a manufacturing company £10,000 in corporation tax through capital allowances.

Saves Time

Delegating financial tasks lets you focus on growing your business.

Scalable Services

As your business grows, accountants can handle forecasting, payroll, and advanced reporting.

Peace of Mind

Complex tax matters like VAT partial exemptions, CIS, or multi-currency dealings become manageable.

Drawbacks

Cost

Full-service accountants charge between £1,000 and £10,000/year, depending on your business’s complexity.

Reduced Familiarity

Relying entirely on an accountant might mean you lose touch with your day-to-day financials.

Top Accounting Software for UK Limited Companies

Even if you hire a professional accountant, using accounting software can significantly improve your company’s financial efficiency. These tools help automate tasks like invoicing, bank reconciliation, and VAT filing and they also ensure you’re compliant with HMRC’s Making Tax Digital (MTD) rules. Whether you’re managing your books solo or working in a hybrid setup, the right software reduces manual errors, saves time, and gives you real-time insight into your business performance.

Here’s a quick comparison of some of the top accounting software solutions tailored for small and limited companies in the UK:

| Software | Best For | Starting Cost | Notable Features |

| Xero | Small Ltd Companies | £14/month | MTD ready, automated bank feeds, smart reporting |

| QuickBooks | Sole Traders & Startups | £12/month | Mileage tracking, invoicing, mobile-friendly |

| FreeAgent | Freelancers | Free with select bank accounts | Project tracking, intuitive dashboard |

| Sage | Growing Businesses | £12/month | Payroll integration, inventory management |

Pro Tip: Many UK business bank accounts (like NatWest, Mettle, or Tide) offer free or discounted subscriptions to accounting software, so be sure to explore bundled offers before subscribing directly..

When to Hire an Accountant vs Doing It Yourself

Deciding between DIY accounting and hiring a professional depends on your business structure, financial complexity, and time availability. Here’s how to evaluate what fits best:

- Sole traders, freelancers, and microbusinesses with simple finances can often manage basic bookkeeping and submit Self Assessment returns using tools like FreeAgent, Xero, or HMRC’s portal.

- Businesses with few transactions and no employees may not require a full-time accountant. Basic software is usually enough to stay compliant and organised.

- Limited companies, VAT-registered businesses, and those with staff should seek professional support. These structures have legal obligations such as Corporation Tax, payroll, and Companies House filings that need expert handling.

- Hiring an accountant adds value beyond compliance. It improves tax planning, reduces risk of penalties, and saves time on complex reporting.

- A hybrid approach works well for many small businesses: handle routine bookkeeping in-house, and consult an accountant for year-end accounts, tax strategy, or funding advice.

________________________________________________________

Tip: Set aside a percentage of your income each month for taxes so you’re not scrambling when the tax bill arrives.

_________________________________________________________________

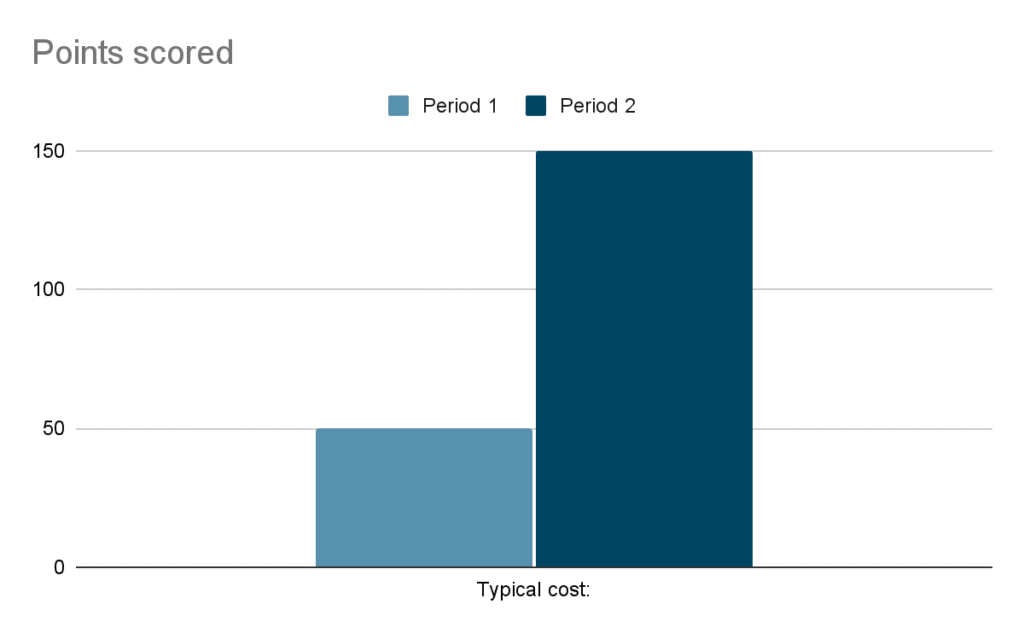

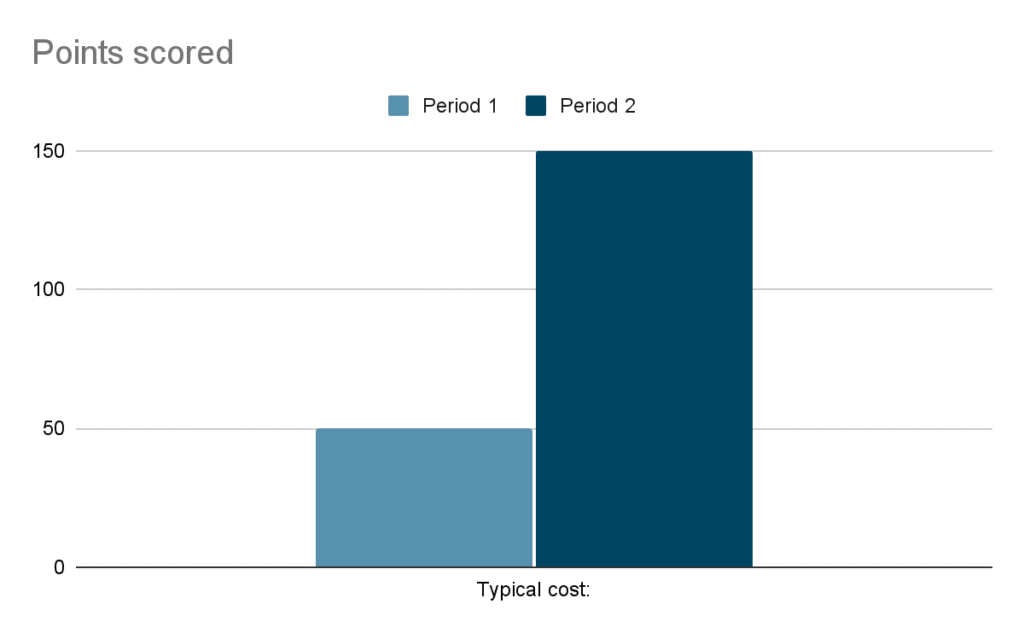

Monthly vs Annual Accountant Costs

|

Learn More : When is Tax Season 2025 in the UK?

What Documents Should You Share with Your Accountant?

Sharing the right documents at the right time helps your accountant work efficiently, keeps your business compliant, and avoids costly delays.

Whether you’re preparing for year-end accounts or working with an accountant on a monthly basis, providing accurate and complete financial records is essential. The smoother the handover, the faster your accountant can identify savings, ensure compliance with HMRC, and reduce the risk of filing errors.

Here’s a practical checklist of what to share:

Key Documents to Prepare

- Bank Statements (Business Accounts): Provide copies or digital access to all business bank and credit card statements. This helps your accountant reconcile your income and expenses accurately.

- Expense Receipts: Keep a record of all business-related expenses, from travel and supplies to subscriptions and software. Digital tools like Dext or Expensify can help automate this.

- Sales Invoices: Share all invoices issued to clients, including unpaid ones. This allows proper revenue tracking and debtor management.

- PAYE & Payroll Information (if applicable): If you have employees or take a director’s salary, include payroll summaries, payslips, and PAYE reports to calculate employer obligations and ensure RTI compliance.

- Previous Tax Filings: Include copies of your last submitted accounts, Corporation Tax returns (CT600), Self Assessments (if you’re a director), and VAT filings.

- Company Registration Details: Your accountant will need your company’s UTR (Unique Taxpayer Reference), Company Registration Number (CRN), and details filed with Companies House.

How the Autumn Budget May Influence Costs

While the Budget didn’t directly change pricing, new regulations could have an impact:

- Making Tax Digital (MTD) Expansion:

More businesses now need to adopt digital tools, potentially raising demand and costs. - VAT Threshold Changes:

Revised limits mean more businesses may need help with VAT returns, increasing accountant workload and fees.

| Key Highlight

Track Expenses Regularly: Don’t wait until year-end to track your expenses. Regularly updating your records ensures you don’t miss out on potential tax deductions. |

Do You Really Need an Accountant In the UK?

Some small businesses, especially in the early stages, try to avoid hiring an accountant to save money. However, this decision can lead to several hidden risks:

- Tax Penalties – Incorrect or late filings can result in costly fines.

- Loss of Time – Handling accounts yourself takes time away from growing your business.

- Missed Financial Opportunities – Accountants can help identify savings, such as eligible expense deductions or suitable VAT schemes.

An accountant is more than just a number-cruncher. They help keep your business compliant, efficient, and financially healthy.

Practical Tips to Reduce Accountant Fees

Worried about high accountant costs? These simple strategies can help reduce fees while still getting the support you need:

- Compare Different Accountants – Request quotes from at least three professionals to find the best value.

- Use Accounting Software – Tools like QuickBooks or Xero can automate basic tasks and reduce the workload for your accountant.

- Bundle Services – Many accountants offer discounted packages when you combine services like bookkeeping and payroll.

A few smart choices can lead to long-term savings.

How to Choose the Right Accountant

Choosing the right accountant is about more than just price. Here are key things to consider before hiring:

-

- Check Their Qualifications – Make sure they are certified by reputable organisations such as ICAEW or ACCA.

- Look for Industry Experience – If your business operates in a specific field, find someone who understands its financial challenges.

- Consider Their Tech Skills – With digital tax rules becoming more common, choose an accountant who is comfortable using cloud-based accounting software.

The right accountant can become a trusted partner in your business journey.

How Do I Select the Right Provider for My Limited Company?

Choosing the right accounting provider can make or break your business’s financial health. Here’s how to ensure you pick the right fit:

Ask the Right Questions

Before signing up, treat the selection process like a job interview. The right provider should understand your business, offer tailored advice, and communicate clearly. Here are a few smart questions to ask:

- Can you explain your approach to common tax deductions relevant to my business?

- What do you think of my current accounting setup?

- How do you prepare clients for tax season?

- What strategies would you suggest to improve my bottom line?

- Do you have experience with companies in my industry?

- Will I be working with one dedicated accountant or a team?

- How do you ensure clients never miss tax or filing deadlines?

- Can you share an example of how you handled a difficult client situation?

- How easy is it to reach you when I need support?

- How will you help me optimise my tax position throughout the year?

These questions will help you understand how proactive, experienced, and accessible a provider is.

Watch Out for Hidden Charges

Don’t just look at the base package price and dig deeper. Some firms charge extra for:

- Self-assessment tax returns

- VAT registration and filings

- Early termination of the contract

- Additional consultations or support

Always clarify what’s included and what’s not before you commit. Transparency is key.

Do Your Research

Go beyond a provider’s website. Check independent review sites, Google reviews, and social media feedback. Better yet, ask other small business owners in your network about their experiences. Real-world feedback can be more honest than polished testimonials.

Customer Support Matters More Than Price

While cost is a factor, the level of support you receive is even more important. If prices are fairly similar across providers, focus on responsiveness and accessibility. Good customer service saves you time, reduces stress, and can even help prevent costly mistakes.

Test their service before committing to send a few questions through their contact form, email, or social media. If you’re struggling to get a reply or can’t even find contact details, that’s a red flag.

How Accounting Saved a Small Business from Penalties (Real Case Study and Insight)

Small businesses often face mounting pressure when it comes to staying compliant with tax laws and financial regulations. One missed deadline or oversight can lead to serious financial penalties. However, with the right accounting support, these risks can be drastically reduced or avoided altogether.

This case study showcases how a proactive and knowledgeable accountant helped a small business owner not only avoid hefty penalties but also restructure their finances for long-term success. The story is a testament to how expert accounting isn’t just about number-crunching, it’s about strategic guidance and financial clarity.

Real-Life Example: David’s Journey from Tax Chaos to Financial Clarity

To understand the real impact of accounting support, let’s look at David’s story:

David, a 38-year-old café owner in Manchester, had been managing his small business for three years. While passionate about food and customer service, he had been neglecting proper bookkeeping, VAT submissions, and company tax obligations due to lack of time and knowledge. One morning, he received a warning letter from HMRC notifying him of overdue filings and potential penalties exceeding £5,000.

Alarmed, David reached out to a small business accountant through a recommendation. What followed was a step-by-step turnaround that changed the course of his business.

- Week 1: The accountant conducted a complete review of David’s financial records. Gaps in VAT returns, late payroll filings, and a missed Companies House confirmation statement were identified. A priority list was prepared to tackle urgent issues first.

- Weeks 2–3: The accountant filed overdue VAT returns and negotiated a payment plan with HMRC. They also submitted the company’s annual accounts and rectified errors in the payroll system to avoid further penalties.

- Weeks 4–6: A new cloud-based accounting system was set up. David and his staff were trained to upload expenses and sales data regularly, ensuring real-time tracking. Automation reduced manual errors, and monthly reports gave David better visibility into his finances.

- Week 7: The accountant enrolled David in a quarterly tax-planning service. Together, they identified allowable deductions and restructured certain expenses to reduce the company’s tax liability. This saved David an estimated £3,200 for the upcoming tax year.

- Week 10: With his records in order, David received a final confirmation from HMRC no penalties would be charged, and his new payment plan had been approved. For the first time, he felt financially in control and confident heading into the next quarter.

David’s transformation was remarkable: what began as a near-crisis turned into a long-term accounting solution. He now reviews his financial dashboard weekly, holds quarterly meetings with his accountant, and no longer dreads communication from HMRC. The right accounting guidance didn’t just save him from penalties it helped him build a more resilient business.

What Determines Value in Accountant Services?

Not all accountants offer the same value. While price is an important consideration, the true value lies in how effectively an accountant helps your business succeed. Here’s how you can assess their value:

- Accuracy: An accountant ensures accurate tax filings and financial reporting, preventing costly mistakes.

- Compliance: Staying updated with HMRC regulations is vital, especially with the growing demands of Making Tax Digital (MTD).

- Efficiency: An efficient accountant saves your time by handling tasks like payroll and VAT returns.

- Strategic Insights: A good accountant identifies opportunities for tax savings or business growth.

Making the Right Choice for Your Business’s Accounting Needs

Understanding the cost of accounting services is essential for small business owners to make informed decisions and manage their finances effectively. While costs can vary based on factors like business structure, service complexity, and location, it’s important to prioritize value over price. At Quilliam Marr, we are dedicated to providing expert accounting services that help businesses stay compliant, optimize tax savings, and ensure financial stability. By carefully assessing your business needs and working with a qualified accountant in the UK , you can avoid unnecessary expenses and set your business up for long-term success.

Frequently Asked Questions

-

What affects the cost of hiring an accountant for a small limited company?

Several factors can influence the cost, including the complexity of your accounts, the number of transactions, your industry’s specific needs, company turnover, and your location. For instance, companies with more employees or VAT obligations may pay more.

-

Do accountants charge hourly or offer fixed packages?

It depends. Many accountants offer fixed monthly or annual packages, especially for small limited companies. Others may charge hourly for one-off services. It’s important to ask upfront to avoid surprise costs.

-

What’s typically included in accounting packages for small limited companies?

Standard packages usually cover bookkeeping, annual accounts, tax returns (like Corporation Tax), payroll, and business advice. Some may include VAT returns, self-assessment, or HMRC correspondence. Always check what’s included before signing up.

-

How do I choose the right accountant for my small limited company?

Start by identifying your needs: do you need basic compliance or strategic support? Then compare services, pricing, and client reviews. A good accountant should be experienced in your industry and easy to communicate with.

-

Can hiring a small limited company accountant actually save me money?

Absolutely. A reliable accountant can help reduce your tax bill, avoid fines, manage cash flow better, and offer growth advice. Many cheap accountants for limited companies still deliver excellent value when chosen wisely.