Payroll tax (mainly National Insurance Contributions) is shared by both employer and employee, while income tax is paid only by the individual based on their total annual income.

In fact, a recent HMRC survey reveals nearly 60% of British small business owners struggle to differentiate between these two taxes. This confusion can lead to costly compliance errors, unexpected fines, or missed savings opportunities.

In this guide, we’ll walk you through:

- What payroll and income taxes actually are

- Who pays what and when

- 2025 tax rates and thresholds

- Common mistakes that can cost your business

- Smart ways to manage both taxes with confidence

Let’s break it all down simply and clearly.

What exactly is Payroll Tax in the UK?

Payroll tax is defined as the National Insurance Contributions (NICs) , a type of tax paid by both employers and employees. It’s deducted automatically from your salary and paid directly to HMRC through the Pay As You Earn (PAYE) system.

Unlike income tax, which goes toward funding public services like education and law enforcement, payroll tax funds the UK’s welfare system, including:

- The NHS

- State pensions

- Maternity and paternity benefits

- Unemployment support

- Disability allowances

If you check your monthly payslip, you’ll usually see “NICs” or “NI” listed as a deduction of your share of the payroll tax handled through our payroll services.

Who Pays Payroll Tax?

Employees

A portion of your gross earnings is deducted automatically and sent to HMRC.

Employers

They pay an additional percentage on top of your salary as their contribution.

Together, these make up the full payroll tax contribution.

How Payroll Tax is Collected (PAYE System)

Most UK employers use the PAYE (Pay As You Earn) system to handle payroll tax. This allows NICs and income tax to be automatically calculated and deducted before your salary is paid.

This means:

- Employees don’t need to file NIC returns themselves.

- Employers are legally responsible for accurate deductions and timely payments to HMRC.

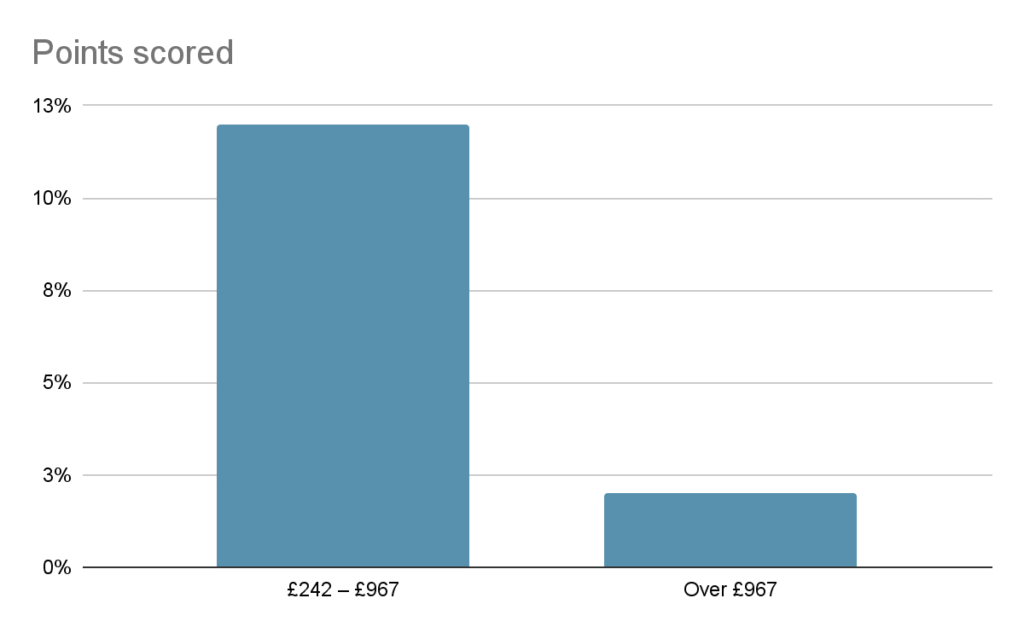

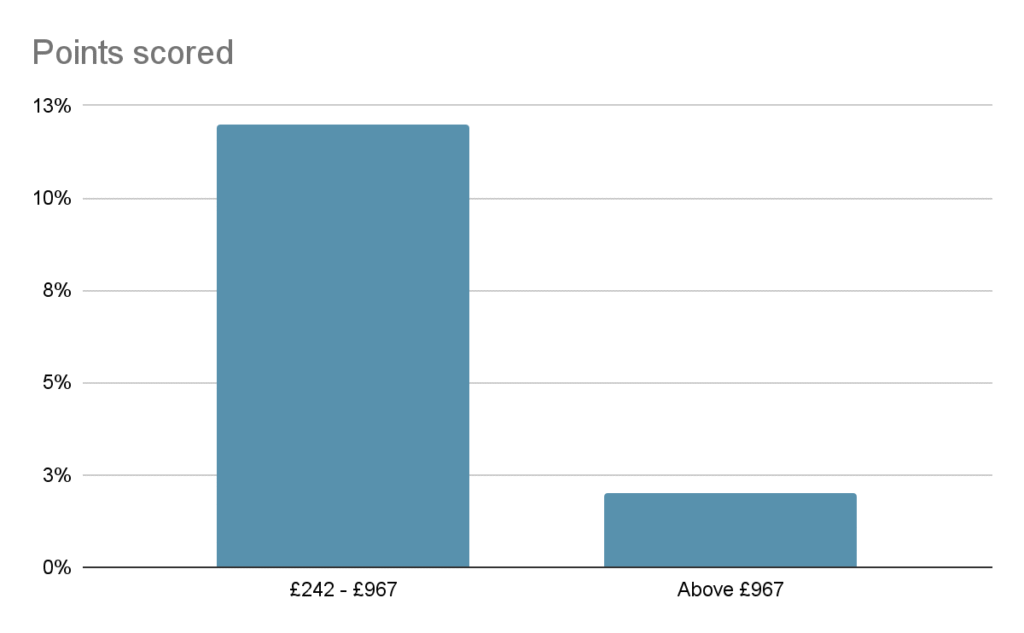

Employee NICs (Class 1 Contributions)

| Weekly Earnings (£) | Employee Rate |

| £242 – £967 | 12% |

| Over £967 | 2% |

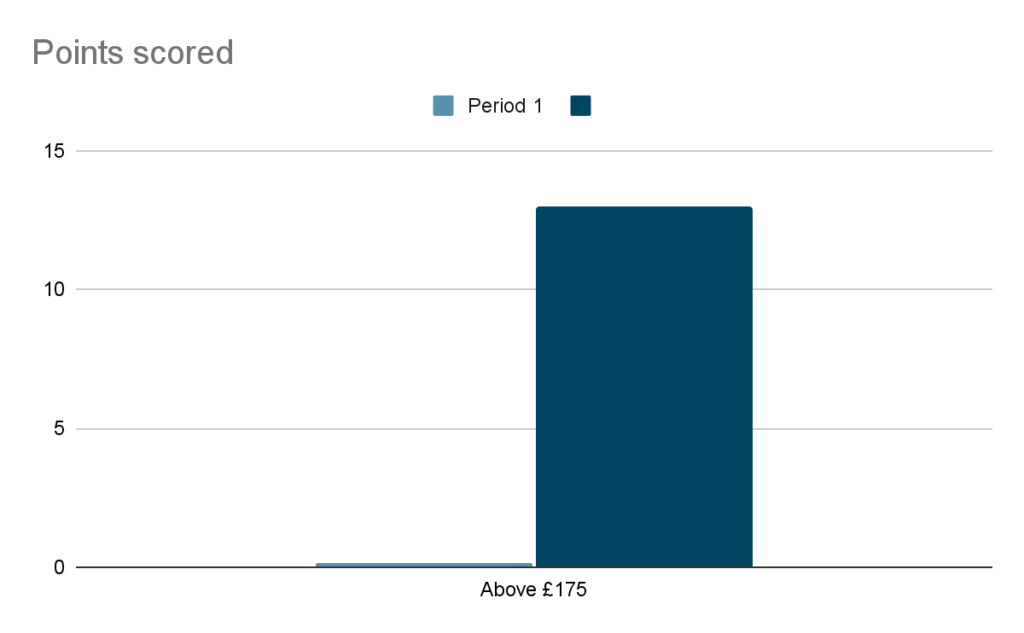

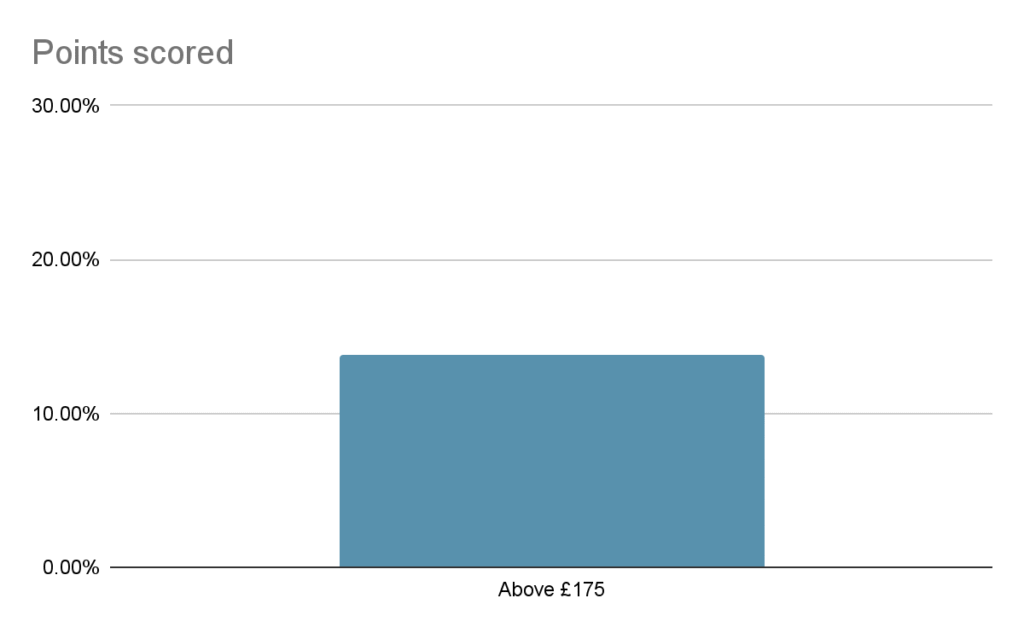

Employer NICs

| Weekly Earnings (£) | Employer Rate |

| Above £175 | 13.8% |

Note: Employees earning below £242 per week don’t pay NICs. Employers, however, still may have to contribute depending on thresholds.

Types of UK Payroll Taxes

1. Employee National Insurance Contributions (NICs)

These deductions show up on your payslip every month, calculated based on your gross earnings. Rates differ based on salary thresholds:

| Earnings per week (£) | Employee NICs Rate (2025) |

| £242 – £967 | 12% |

| Above £967 | 2% |

2. Employer National Insurance Contributions

Employers must also contribute to NICs, calculated as a percentage of employee salaries.

| Earnings per week (£) | Employer NICs Rate (2025) |

| Above £175 | 13.8% |

Research by the Institute for Fiscal Studies (IFS) found payroll taxes (NICs) raised around £158 billion in 2024, funding nearly half of the UK’s welfare budget.

Understanding Income Tax in the UK: It’s More than Just a Deduction

Income tax is paid only by individuals on the total income they earn over a year. This includes money from:

- Employment (salary or wages)

- Self-employment

- Rental income

- Savings and investments

- Pensions

Unlike NICs, income tax does not fund welfare programs. Instead, it contributes to essential public services such as:

- Education

- Law enforcement

- Transport infrastructure

- Defence and national security

How Income Tax is Collected

There are two main ways income tax is collected in the UK:

- PAYE (Pay As You Earn)

If you’re an employee, your employer deducts your income tax each month before paying you, based on your tax code. - Self-Assessment

If you’re self-employed or have other income (like rental income or dividends), you must file a Self Assessment tax return each year and pay directly to HMRC.

UK Income Tax Rates (2025)

Income tax rates vary based on annual earnings:

| Income Bracket (£) | Income Tax Rate |

| Up to £12,570 | 0% (Personal Allowance) |

| £12,571 to £50,270 | 20% (Basic Rate) |

| £50,271 to £150,000 | 40% (Higher Rate) |

| Above £150,000 | 45% (Additional Rate) |

Who Needs to Pay Income Tax?

You must pay income tax if:

- You’re a UK resident earning over £12,570 per year

- You’re self-employed, a landlord, or a shareholder earning dividends

- You earn additional income from freelance work or side businesses

Even if you’re on PAYE, you may still need to file a Self Assessment return if you:

- Earn over £100,000

- Have untaxed income

- Claim certain tax reliefs (like business expenses)

| Did You Know !

Over 95% of income tax returns are now filed online and the UK’s “Making Tax Digital” initiative is expanding to include even more self-employed individuals in the coming year. |

7 Key Differences Payroll Tax vs. Income Tax

Understanding these key differences clearly can help you handle tax obligations smoothly, avoiding costly errors:

| Aspect | Payroll Tax (NICs) | Income Tax |

| Purpose & Allocation | Funds welfare (e.g., NHS, pensions, benefits) | Funds public services, infrastructure, defence |

| Taxpayer Responsibilities | Shared by employer and employee | Primarily individual; employers deduct only |

| Calculation Method | Flat-rate percentage (weekly/monthly earnings) | Progressive rate (increases with earnings) |

| Tax-Free Allowance | Lower threshold (£242 per week) | Higher personal allowance (£12,570 per year) |

| Impact on Employers | Employers bear significant cost | Employers deduct but don’t personally pay |

| Reporting & Filing | Monthly/Quarterly (via PAYE) | Annual self-assessment or PAYE deducted |

| Consequences of Non-Compliance | Higher penalties, frequent audits | Penalties significant but negotiable with HMRC |

Income Tax Differences by Country

While payroll taxes focus on social security and national benefits, income tax directly affects employees’ take-home pay. Most countries follow a progressive income tax model, meaning the more you earn, the more tax you pay but the rules, brackets, and responsibilities differ widely.

Here’s how income tax is handled in four key countries:

United States:

The U.S. income tax system operates at both federal and state levels. In 2024, federal tax rates range from 10% to 37%, depending on your income bracket. For example:

- Income between $11,001 and $44,725 is taxed at 12%

- Income between $44,726 and $95,375 is taxed at 22%

On top of this, most states impose their own income taxes except for a few like Texas, Florida, and Nevada, which have no state income tax, giving residents in those states a clear advantage.

China:

China’s individual income tax system is also progressive, with rates ranging from 3% to 45%. For example:

- Earnings between 144,000 CNY and 300,000 CNY are taxed at 20%

- Earnings between 660,000 CNY and 960,000 CNY are taxed at 35%

The income tax system applies to both residents and certain non-residents, and includes deductions for items like housing, education, and parental care — making payroll processing for international staff more complex.

South Africa:

In South Africa, income tax applies on a sliding scale, starting at 18% and reaching 45% for high earners. Employees earning between R237,101 and R370,500 fall into the 26% tax bracket, while those above R1.8 million pay 45%.

South African residents are taxed on worldwide income, while non-residents are only taxed on local income. Employers handle tax withholding through the Pay-As-You-Earn (PAYE) system, which is similar to the UK’s structure.

United Kingdom:

UK income tax is divided into bands and applies after the £12,570 personal allowance:

- Earnings from £12,571 to £50,270 are taxed at 20% (basic rate)

- Earnings from £50,271 to £125,140 are taxed at 40%

- Earnings above £125,140 are taxed at 45%

Unlike many countries, the UK also requires employers to handle National Insurance Contributions (NICs) alongside income tax via the PAYE system, making it crucial for businesses to clearly differentiate between income tax and payroll tax obligations.

What’s the Role of PAYE in Managing Taxes?

PAYE (Pay As You Earn) is the system through which most employees have their income tax and National Insurance Contributions (NICs) automatically deducted from their wages. It simplifies tax collection by placing the responsibility on employers to calculate, deduct, and report taxes on behalf of their staff. This ensures employees don’t need to handle tax returns themselves unless they have additional income sources.

Here’s how PAYE supports payroll and income tax management:

- Automatic deductions: Employers deduct income tax and NICs directly from salaries before paying employees.

- Real-time reporting: PAYE operates under HMRC’s Real Time Information (RTI) system, requiring employers to submit payroll data each time staff are paid.

- Accurate tax codes: PAYE uses employee tax codes to determine the correct amount of tax and NICs to deduct.

- HMRC submissions: Employers must send a Full Payment Submission (FPS) on or before payday and, if needed, an Employer Payment Summary (EPS) for adjustments.

- Timely payments: Employers must pay collected tax and NICs to HMRC by the 22nd of each month (for electronic payments).

- Use of payroll software: Many businesses use tools like HMRC’s Basic PAYE Tools, Xero, QuickBooks, or Sage to manage PAYE efficiently and avoid compliance errors.

Best Practices for Payroll and Income Tax Management

Whether you’re running payroll for a small team or managing hundreds of employees across the UK, having strong internal processes is essential. Mistakes in tax withholding or reporting can lead to HMRC penalties, employee complaints, and financial setbacks. That’s why a well-structured payroll and income tax system is more than a formality; it’s a compliance necessity.

Here are some best practices every UK employer should follow:

1. Stay compliant with HMRC regulations and deadlines

Always refer to the official HMRC employment tax calendar to stay ahead of monthly and quarterly reporting. Submitting your PAYE (Pay As You Earn) and National Insurance Contributions (NICs) on time ensures you avoid interest charges or late-filing penalties. Set up reminders or use payroll software with automatic alerts.

2. Correctly classify employees and contractors

Misclassifying a contractor as an employee (or vice versa) can result in serious tax errors.

- Employees: Subject to income tax and NICs through PAYE.

- Contractors: Handle taxes via Self Assessment (unless under IR35).

Follow HMRC’s employment status checker to avoid confusion and stay compliant with UK labour rules.

3. Account for voluntary deductions

If your business offers benefits such as pension schemes, union fees, or private healthcare, these voluntary deductions must be handled carefully through payroll. They affect the employee’s taxable pay and must be reported properly to HMRC.

4. Use modern payroll software

Automating payroll processes reduces manual errors and improves tax accuracy. Top-rated tools like Xero, Sage, QuickBooks, and BrightPay integrate tax rules, track earnings, calculate NICs, and generate reports in real time. These platforms also help with:

- PAYE submissions (FPS & EPS)

- Generating payslips

- Syncing with your general ledger for accounting accuracy

5. Regularly audit your payroll records

Schedule periodic checks to ensure employee records (salaries, tax codes, benefit deductions) are up to date. Changes in hours, roles, or benefits should immediately reflect in payroll to avoid incorrect filings or underpayments.

6. Prepare for tax year-end reporting

UK employers must complete year-end reports, including:

- P60s for all employees

- P11Ds for taxable benefits

- Final FPS submissions by 5 April

Planning ahead reduces last-minute stress and ensures accurate reconciliation of payroll and tax reports.

Top 3 Common Mistakes Businesses Make with Payroll & Income Tax

Mistake #1: Mixing Payroll and Income Tax Payments

Avoid combining these tax payments, as they’re separate obligations with different deadlines.

Mistake #2: Forgetting Employer NICs

Employer NICs must be factored into budgeting—ignoring this can severely disrupt cash flow.

Mistake #3: Incorrect Classification of Workers

Misclassifying employees as freelancers (or vice versa) significantly affects tax obligations.

How to Manage Your Payroll and Income Taxes Effectively (2025)

To ensure compliance and maximize savings, adopt these best practices:

1. Automate Your Payroll Processes

Use payroll software (Xero, QuickBooks, Sage) to simplify NIC and PAYE calculations.

2. Hire or Consult Tax Specialists

Engaging professional advisors reduces the risk of costly compliance errors.

3. Regularly Review HMRC Updates

Tax rules change—staying updated via gov.uk helps avoid surprises.

Insight from Recent ResearchA recent Deloitte study highlighted that SMEs save 15% in tax compliance costs when using cloud-based payroll software. |

What Are the Employer’s Responsibilities for Payroll and Income Tax Compliance?

For UK businesses, staying compliant with payroll and income tax laws isn’t just about ticking boxes, it’s about avoiding penalties, protecting employee trust, and staying in HMRC’s good books.

Here’s what every employer must do:

1. Calculate and Withhold the Right Amounts

You must deduct:

- Income tax using the correct tax code

- Employee National Insurance Contributions (NICs)

- Other deductions like student loans, pension contributions, or benefits-in-kind

You’ll also need to add employer NICs (13.8%) on top of gross salaries.

Most businesses automate this using HMRC-recognised payroll software like Xero, Sage, or BrightPay to avoid miscalculations.

2. Submit Returns and Pay on Time

Tax reporting and payment follow strict timelines:

- Full Payment Submission (FPS): Every time you run payroll

- Employer Payment Summary (EPS): If adjustments (like statutory leave or reclaiming reliefs) are needed

- Tax/NIC payments to HMRC: By the 22nd of each month (if paying electronically)

Late payments can lead to interest charges and automatic penalties from HMRC.

3. Issue Year-End Documents

You must provide:

- P60: Annual pay & tax summary for employees (due by 31 May)

- P11D: If your team receives benefits-in-kind (due by 6 July)

- P45: For employees leaving the business

These help employees file tax returns, access benefits, or apply for loans.

4. Stay Updated on Tax Law Changes

UK tax laws and thresholds change yearly, sometimes mid-year. Stay informed about:

- New tax codes or rates

- NIC threshold updates

- HMRC policy changes (e.g. IR35, off-payroll rules)

- Pension auto-enrolment updates

Keeping your system updated ensures full compliance and prevents errors.

FAQs

Who is exempt from federal income tax?

Individuals whose total income falls below the IRS annual threshold may be exempt from paying federal income tax. or exemption levels range between $13,850 and $29,200, depending on filing status (single, head of household, or married).

Common groups that may be exempt include:

- Low-income earners

- Retirees relying solely on Social Security

- Some dependents and children

- Certain tax-exempt organizations’ workers

Always confirm your filing status and eligibility using IRS tools or a tax advisor.

Can payroll taxes be deducted from income tax?

For self-employed individuals, yes. They can deduct the employer-equivalent portion of their FICA (Social Security and Medicare) taxes when filing personal income tax returns.

However, W-2 employees cannot deduct the payroll taxes withheld from their paycheck; those contributions are already settled through the PAYE (or U.S. equivalent) system.

Do workers pay more in payroll taxes or income taxes?

It depends on income level:

- Low- to middle-income earners often pay more in payroll taxes (NICs/FICA) because these are flat-rate and apply from the first pound/dollar earned.

- Higher-income earners may pay more in income tax due to progressive tax brackets, especially once they exceed the NIC or FICA thresholds.

So the tax burden shifts depending on how much you earn.

Is income tax paid the same as income tax withheld?

Not always. Income tax withheld is the amount deducted by your employer throughout the year. It is what you actually owe based on total annual earnings, deductions, and credits. If your employer under-withheld, you’ll need to pay the difference when filing your tax return. If they over-withheld, you’ll receive a refund.

Can I claim a refund for overpaid income tax or NICs?

Yes. If you’ve paid too much income tax often due to an incorrect tax code, switching jobs, or over-deductions you can claim a refund from HMRC via their online service.

For National Insurance (NICs), overpayments may also be refunded, especially if you’ve worked multiple jobs or switched between employed and self-employed statuses within the same tax year.

What happens if I earn below the personal allowance threshold?

If your total annual income is below £12,570 (as of 2025), you won’t pay any income tax due to the Personal Allowance. However, you may still pay National Insurance (payroll tax) if your weekly earnings exceed £242.

Are bonuses and overtime subject to income and payroll taxes?

Yes. Bonuses, commissions, and overtime pay are treated as part of your earnings and are subject to both income tax and NICs. They are taxed through the same PAYE system, which may lead to a higher deduction in the month the bonus is paid.

How do I check if I’m on the correct tax code?

Your tax code is shown on your payslip. It determines how much tax your employer deducts from your wages. Use HMRC’s tax code checker tool to see if your code is correct. If it’s wrong, you could overpay or underpay income tax.

Are NICs refundable when leaving the UK permanently?

If you’ve paid Class 1 NICs as an employee and plan to leave the UK permanently, you cannot usually get a refund of your contributions.

However, in some cases, if you move to a country with a reciprocal agreement, your contributions may count towards your state pension or social benefits abroad.

Wrapping Lines!

Understanding the difference between payroll tax and income tax is essential for staying compliant and avoiding unnecessary penalties. Whether you’re an employee reviewing your payslip or an employer managing payroll, knowing what each tax funds and how it’s collected can help you make smarter decisions.

Mistakes in payroll or tax reporting can be costly but with the right knowledge and tools, they’re easy to avoid. At Quilliam Marr, we help UK businesses simplify payroll, manage taxes efficiently, and stay up to date with HMRC changes. Need support? Reach out today and let’s make tax stress-free together.

Need Help with Payroll or Tax Planning?

Whether you’re a startup, growing SME, or just need advice on your tax obligations, reach out to our team . Let us help you streamline your financial future.