Paying too much tax as a UK small business owner?

Many businesses lose thousands every year by missing out on tax reliefs they legally qualify for. And with changing HMRC rules, it’s easy to overpay without even knowing. These extra costs eat into your profits and limit your growth.

This guide breaks down 10 proven tax-saving strategies for small businesses in the UK. You’ll learn how to reduce tax using expense claims, dividend payments, pension contributions, VAT schemes, and more. If you’re searching for UK small business tax tips, this is the clear, no-fluff list you need right before the 5 April deadline.

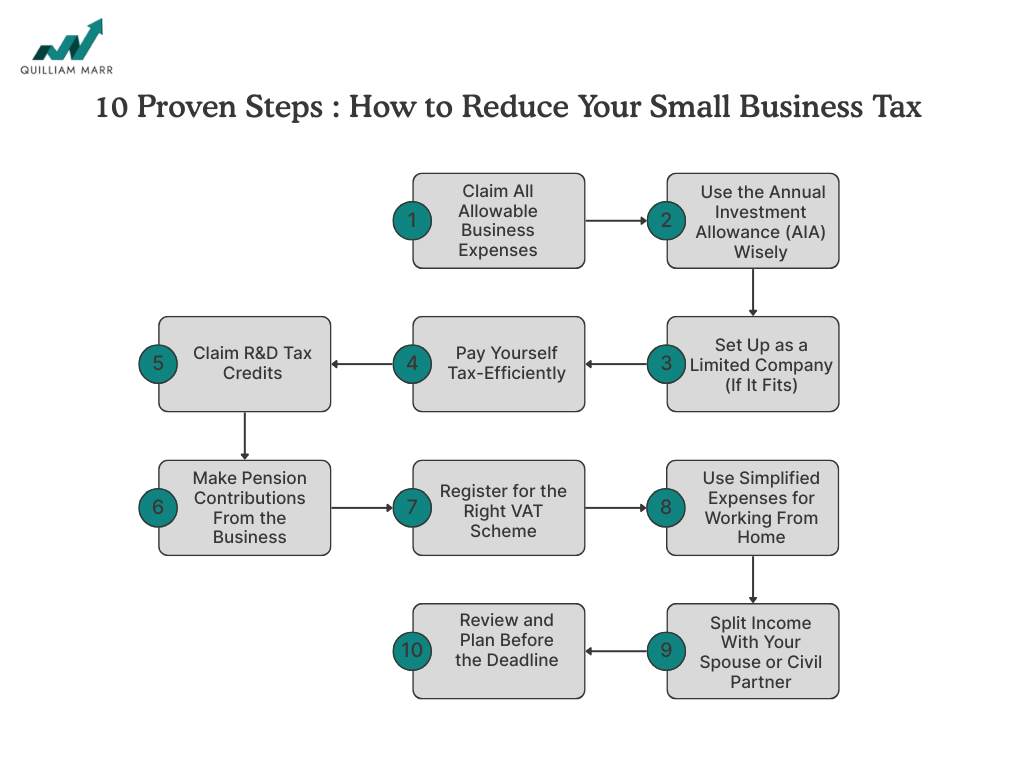

How to Reduce Your Small Business Tax : 10 Proven Steps

Here are 10 simple and legal ways to pay less tax and keep more of your business profits.

1. Claim All Allowable Business Expenses

You can reduce your taxable profit by claiming every business expense allowed by HMRC.

If your business spends money for trade, most of those costs can be claimed to lower your tax bill. This includes things like:

- Office rent and business utilities

- Phone and internet used for business

- Travel for client meetings or site visits

- Software subscriptions, marketing costs, and website hosting

- Staff wages and pension contributions

You can also claim home office tax relief in the UK if you work from home, using simplified expenses or actual costs.

Missed claims mean overpaid tax. Keep records for all business-related spending and match each one with proof, like receipts or invoices. Using bookkeeping software helps track these through the year.

Tip: Always check if something is “wholly and exclusively” for business use. That’s the HMRC rule that matters.

2. Use the Annual Investment Allowance (AIA) Wisely

The Annual Investment Allowance (AIA) lets you deduct 100% of qualifying equipment costs from your taxable profit.

You can claim up to £1 million per year under AIA. This applies to assets like:

- Laptops, computers, and printers

- Tools and machinery

- Office furniture

- Vans or other business vehicles (not cars)

Let’s say you buy new computers for £3,000. Instead of spreading the cost over years, you deduct the full £3,000 in the same tax year cutting your Corporation Tax or Income Tax.

Important: You must claim in the same financial year the item was purchased and used.

Avoid these mistakes:

- Don’t delay the purchase to next year if you haven’t used up your AIA

- Don’t claim for items bought for personal use

- Cars have different rules they usually don’t qualify for AIA

This allowance is a quick win if you plan ahead. Buying needed assets before 5 April 2025 can help you save this year.

3. Set Up as a Limited Company (If It Fits)

Switching from sole trader to limited company can lower your tax bill if your profits are high enough.

As a sole trader, you pay Income Tax and Class 2 and Class 4 National Insurance on all profits. But a limited company pays Corporation Tax (currently 25% or less), and you can choose how to pay yourself, usually a mix of salary and dividends.

Here’s what makes limited companies tax-friendly:

- Dividends have a lower tax rate than income

- You only pay Corporation Tax on profits, not personal tax on everything

- You can control the timing of payments to manage your personal tax

- Business and personal assets are legally separate

But it’s not always better. If your profits are under £30,000 per year, the admin and accounting costs may not be worth it.

Use this if:

- You earn over £50,000/year in profit

- You want flexibility in how and when to take income

- You plan to grow and reinvest profits in the company

Talk to a tax advisor before switching to see if it’s the right move based on your specific situation.

4. Pay Yourself Tax-Efficiently – Salary vs Dividends

Mixing salary and dividends can help reduce your personal tax if you run a limited company.

Most directors in the UK take a small salary and top up the rest of their income with dividends. This method avoids paying high National Insurance while keeping income within lower tax bands.

Here’s a common approach:

- Salary up to the Primary Threshold (£12,570) – keeps you in the tax-free range

- Dividends up to £500 (tax-free dividend allowance)

- Any extra dividends taxed at lower rates than income

Why it works:

- You still get State Pension credits with a low salary

- Dividends are not subject to National Insurance

- You control how much and when to take profits

Example:

- Salary: £12,570

- Dividends: £37,430

- Total income: £50,000

- Tax: Much less than taking £50,000 entirely as salary

This strategy works only for limited company owners. Sole traders can’t pay themselves this way; they just pay tax on all profits.

Tip: Make sure to issue proper dividend paperwork and keep accounting records. HMRC expects proof that dividends came from post-tax profit.

5. Claim R&D Tax Credits (Even for Small Innovations)

You can get cash back or a lower tax bill by claiming R&D tax credits—even if you’re a small business.

Many UK businesses think R&D tax relief is only for tech startups or big firms. That’s not true. If you’re solving problems with new processes, software, or product designs, you might qualify.

Here’s what counts as R&D:

- Developing new internal systems

- Improving products to meet new standards

- Creating unique software or apps

- Automating manual business processes

If you’re spending money on staff, prototypes, testing, or software for the project, those costs can be claimed.

You could get:

- A cash rebate (if you made a loss)

- A cut in your Corporation Tax bill (if profitable)

Use the HMRC SME R&D relief scheme. Keep notes on what was tried, what failed, and what worked. This builds your claim case.

Tip: Even failed projects can qualify if you were solving a technical uncertainty.

6. Make Pension Contributions From the Business

Pension contributions made through your company are a tax-deductible business expense.

If you run a limited company, you can pay into your pension directly from the business. This lowers your taxable profit and cuts your Corporation Tax bill. You also avoid paying personal Income Tax and National Insurance on that amount.

Example:

If your company makes a £10,000 pension contribution:

- You save up to 25% in Corporation Tax (£2,500 saved)

- You boost your retirement pot

- You reduce the amount of taxable income taken personally

Key rules:

- The payment must be for “wholly and exclusively” business purposes

- Stay within the annual pension allowance (£60,000 for 2025)

- Use a registered pension scheme

For sole traders, pension contributions still give tax relief, but you claim them on your Self Assessment instead.

Tip: Make contributions before 5 April 2025 to use the relief in this tax year.

7. Register for the Right VAT Scheme

Choosing the best VAT experts scheme for your business can save time and reduce how much VAT you owe.

If your business earns over £90,000 in taxable turnover (2025 threshold), you must register for VAT. But even if you’re under that, voluntary registration can help—if you reclaim more VAT than you charge.

There are several schemes:

- Standard VAT Accounting

- You charge VAT on sales and reclaim on purchases

- Suits businesses with steady cash flow and high VAT costs

- Flat Rate Scheme

- You pay a fixed rate (based on your industry) on gross turnover

- You don’t reclaim VAT on most purchases

- Good for service businesses with low expenses

- Cash Accounting Scheme

- You pay VAT only when you get paid (not when you invoice)

- Helps with cash flow for late-paying clients

Tip: Pick the scheme that fits your cash flow and expenses. The wrong one could mean overpaying VAT.

8. Use Simplified Expenses for Working From Home

If you run your business from home, you can claim part of your home costs and simplified expenses make it easy.

HMRC allows small business owners and sole traders to use a flat-rate method instead of tracking exact utility bills, rent, or mortgage interest.

2025 Flat Rates (based on hours worked from home each month):

- 25 to 50 hours: £10/month

- 51 to 100 hours: £18/month

- 101+ hours: £26/month

This method doesn’t cover things like the internet or phone, which you should claim separately based on business use.

Actual Cost Method

You can also claim a portion of your actual bills (gas, electric, water, broadband), but you’ll need detailed calculations and records.

Best for:

- Sole traders using part of their home as an office

- Small businesses with limited home expenses who want easy record-keeping

Tip: If you’re a director of a limited company, consider creating a rental agreement for part of your home. It must be formal, and the rent must be reasonable.

9.Split Income With Your Spouse or Civil Partner

Sharing business income with a spouse or civil partner can reduce your combined tax bill.

This works best when one partner is in a lower tax band—or has unused personal allowances.

Ways to split income legally:

- Add them as a shareholder in your limited company

- You can then pay dividends to both of you

- Pay them a salary for actual work done

- This is tax-deductible and gives them State Pension credits

- Use the Marriage Allowance (if applicable)

- If one earns below the personal allowance, they can transfer part of it to the other

Example:

Your spouse has no income. If they receive £12,570 in dividends from your company, it’s all tax-free under the 2025 personal allowance and dividend threshold.

Rules to follow:

- The work or role must be real

- Pay must be reasonable for the duties

- Dividends must come from company profits and share ownership

Tip: Always document payments properly, especially for salaries. HMRC can ask for proof at any time.

10.Review and Plan Before the Deadline

Most tax-saving moves only work if you act before the end of the tax year—5 April 2025.

Many small business owners wait until tax return season, but that’s too late to make real savings. You need to review your income, expenses, and allowances while there’s still time to act.

What to check before 5 April:

- Have you used your full Annual Investment Allowance?

- Can you make a pension contribution this year?

- Is there profit left to extract as dividends?

- Should you buy essential equipment now, not later?

- Can you issue salaries to staff or yourself before year-end?

Tip: Make a checklist and book a review meeting with your accountant in March every year. That gives you enough time to act on advice and reduce your bill legally.

Note: Need help applying these strategies to your business? Our small business accountants can guide you.

Tax Planning for High-Income Individuals & Business Owners

If you earn over £100,000 or run a profitable company, you may face steeper tax rates and stricter limits on allowances. But there are legal ways to reduce your bill and they work best when planned early.

-

Tapered Annual Allowance and Pension Contributions

High-income earners face a reduced pension annual allowance. Once your adjusted income exceeds £260,000, your pension limit begins to shrink. For every £2 above that level, your annual pension allowance drops by £1. The minimum allowance you can receive is £10,000 per year.

To reduce your tax bill:

- Use salary sacrifice to contribute more into your pension

- Make sure total contributions (including from your employer) stay within the limit

- Track your adjusted income, not just your salary

Failing to plan for tapering could result in unexpected tax charges on excess contributions.

- Tax Strategies for Higher-Rate Taxpayers

If you’re in the 40% or 45% tax band, planning how you earn and invest your income is key. These methods can help reduce what you owe legally:

Maximise Tax-Free Investments

- Use your ISA allowance of £20,000 per year (tax-free growth and withdrawals)

- Invest in Venture Capital Trusts (VCTs) or Enterprise Investment Schemes (EIS)

- Up to 30% Income Tax relief

- Tax-free dividends (VCTs)

- Capital Gains Tax deferral or exemption (EIS)

Use Salary Sacrifice Schemes

Exchange part of your salary for:

- Pension contributions

- Electric vehicles (via salary sacrifice)

- Childcare vouchers (if still eligible)

This lowers your taxable income and can reduce exposure to the 60% effective tax rate between £100,000–£125,140.

-

Maximise Deductions and Company Benefits

If you’re a business owner or director, review every possible cost and benefit:

Claim All Allowable Business Expenses

- Office costs: rent, phone, broadband

- Business travel, client meetings

- Software and subscriptions

- Part of your household bills if you work from home

Example:

Sophie, a freelance consultant, works from home and deducts £5,000 in costs across internet, utilities, and equipment. This lowers her taxable profit and saves over £2,000 in tax.

Tip: Need help applying these strategies? This guide explains when to hire a business tax accountant and what to expect.

Understand Employer Share Schemes

If your company offers share options or incentives, these can give major tax benefits:

- Save As You Earn (SAYE): Buy shares at a 20% discount. Pay no Income Tax or National Insurance if you hold them for 3–5 years.

- Enterprise Management Incentives (EMI): No tax on grant or exercise if conditions are met

- Share Incentive Plans (SIPs): Receive free or discounted shares completely tax-free

Example:

David joins his employer’s EMI scheme and buys shares at £5. After 3 years, they’re worth £15. He pays no Income Tax or Capital Gains Tax on the gain—saving thousands.

Learn more about choosing the best accountants for growing companies and how the right support can impact your tax strategy.

Smart Planning for Business Owners and the Self-Employed

Corporation Tax Planning

Corporation Tax in 2025 is:

- 19% on profits under £50,000

- 25% on profits over £250,000

- A tapered rate in between

Reduce tax by:

- Investing in capital equipment (claim capital allowances)

- Making pension contributions from the company

- Paying yourself using salary + dividends (tax-efficient mix)

VAT Strategy

- Turnover over £90,000 = must register

- Use Flat Rate Scheme to simplify payments

- Use Cash Accounting to delay VAT until invoices are paid

Example:

Mike invests £10,000 in new equipment. His profits drop from £80,000 to £70,000, saving £2,500 in Corporation Tax.

Tax Benefits of Self-Employment

If you’re self-employed, there’s more flexibility in how and when you pay tax.

- Deduct home office costs, software, training, and equipment

- Pension contributions of up to £60,000 qualify for full tax relief

- Spread income across tax years to stay in lower tax bands

Example:

Emma earns £100,000. She contributes £20,000 to a pension, reducing her taxable income to £80,000. That saves £8,000 in tax at 40%.

Inheritance and Gift Planning

Without proper planning, 40% Inheritance Tax (IHT) could apply to estates over £325,000. Here’s how to reduce it:

Gift Aid

- Donating to UK-registered charities boosts your tax relief

- Higher-rate taxpayers can claim back 20–25% on donations

- Payroll giving reduces taxable income

Example:David donates £5,000. Charity claims £1,250 in Gift Aid, and David reclaims £1,250 in Income Tax relief halving the real cost of his donation.

Inheritance Tax Relief

- Use your £3,000 annual gift allowance

- Larger gifts are IHT-free after 7 years

- Leave your home to a direct descendant to use the residence nil-rate band (£175,000)

Example:

Sarah gifts £250,000 to her son. If she lives 7 more years, the full amount is IHT-free, saving £100,000 in potential tax.

Frequently Asked Questions

How can I reduce my tax bill as a small business owner in the UK?

Claim all allowable expenses, use the Annual Investment Allowance, make pension contributions through the company, and use salary + dividends if you’re incorporated.

When should I switch from sole trader to limited company?

When your profits exceed £30,000–£50,000, switching often saves tax through lower Corporation Tax and dividend options.

What’s the most overlooked tax relief?

Many small businesses miss out on R&D tax credits, even if they aren’t tech companies. Any project that solves technical problems could qualify.

How much can I contribute to a pension before it’s taxed?

You can contribute up to £60,000 per year. If your adjusted income is over £260,000, the tapered allowance may apply.

What’s the best VAT scheme for service-based businesses?

The Flat Rate Scheme is often better for service businesses with low costs—it simplifies reporting and can reduce VAT owed.

Can I pay my spouse to save tax?

Yes, if they actually work in your business. Salary must be reasonable, and dividends can be paid if they hold shares.

How can I reduce Inheritance Tax in the UK?

Make use of gift allowances, donate through Gift Aid, use trusts where appropriate, and leave your home to children to access the residence nil-rate band.

Your Next Step Towards Tax Efficiency!

Tax planning isn’t something you leave to the last minute. Whether you’re a high earner, self-employed, or run a growing business, there are ways to reduce your tax bill throughout the year.

But most people don’t know where to start or what reliefs they’re missing. That’s why a clear plan makes all the difference.

A professional accountants at Quilliam Marr helps you cut unnecessary tax with practical steps that match your income and goals. From pension contributions to dividend strategies, we make tax-saving simple.